Winter blues: how much damage could Omicron do to the UK economy?

The chief worry may not be the necessity for another furlough, but big ‘inflationary pressures’

“We’ve always acknowledged there could be bumps on our road to recovery,” observed the Chancellor, Rishi Sunak, last week. Omicron looks like a sizeable one, said Simon Duke in The Times. Before the variant struck, it seemed “all but certain” that the Bank of England would this week lift borrowing costs from a historic low of 0.1% to tackle rising prices. Indeed, ahead of the decision to increase the interest rate to 0.25%, some economists were still arguing that a raise would send the important message that policymakers are serious about tackling inflation, which jumped to a ten-year high of 5.1% in November. For most, however, “the pendulum has swung decisively in the other direction”. There are now real fears that the economy will contract, said Maike Currie of Fidelity on Sky News. “The BoE will be acutely aware that it’s harder to dig an economy out of recession than to cool rising inflation.”

In fact, “Britain’s economic recovery had come close to stalling”, even before the onset of the new variant, said Larry Elliott in The Guardian. ONS figures show that in October – the first month after the end of the furlough scheme – output grew by just 0.1%, with signs of “a sharp drop-off in visits to restaurants, pubs and bars”. They have now been whacked even further by the tougher Plan B curbs. “Of the three main sectors of the economy, only services expanded in October.” Manufacturing fell by 0.6%, and construction by 1.8% – “the steepest fall since April 2020”. The effect of Omicron on inflation is “unclear”, said the FT. But the variant is certainly “likely to soften growth” – spreading the slowdown to the services sector, especially after the changed guidance on working from home. “Monetary easing, at this point, can do little to help. Fiscal policy – government spending – is the right way to support the economy.”

“The Treasury will hate the idea of another furlough, let alone more bounceback loans and support for the self-employed,” said James Moore in The Independent. But if the pandemic worsens, it may be the only way to save legions of businesses in hard-hit sectors which have only just emerged from “hibernation”. The last lockdown borrowing bill was huge, but it was “good borrowing”, which “facilitated a faster recovery”. The new restrictions “are not the main cause of the pain now being felt in the economy”, said Jeremy Warner in The Daily Telegraph. “Rather, it is the gathering sense of public panic.” As things stand, it’s unclear whether there’s “justification for another round of business support”. Indeed, “I’m willing to bet” that, three months on, the chief worry will not be the necessity for another furlough, but big “inflationary pressures”.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Create an account with the same email registered to your subscription to unlock access.

-

Italian senate passes law allowing anti-abortion activists into clinics

Italian senate passes law allowing anti-abortion activists into clinicsUnder The Radar Giorgia Meloni scores a political 'victory' but will it make much difference in practice?

By Chas Newkey-Burden, The Week UK Published

-

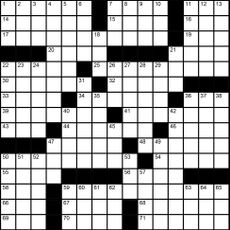

Magazine interactive crossword - May 3, 2024

Magazine interactive crossword - May 3, 2024Puzzles and Quizzes Issue - May 3, 2024

By The Week US Published

-

Magazine solutions - May 3, 2024

Magazine solutions - May 3, 2024Puzzles and Quizzes Issue - May 3, 2024

By The Week US Published

-

Shein: could the year’s mega-IPO fall apart at the seams?

Shein: could the year’s mega-IPO fall apart at the seams?Talking Point Latest hitch is a pre-float 'security review' that could deter potential investors

By The Week UK Published

-

Labor market strong as inflation sinks

Labor market strong as inflation sinksFeature And more of the week's best financial insight

By The Week US Published

-

Midair blowout: another black mark for Boeing

Midair blowout: another black mark for BoeingFeature This isn't the first production issue Boeing has encountered

By The Week US Published

-

Behemoths of the seas

Behemoths of the seasThe Explainer Cruise liners keep getting bigger, with the world’s largest 'megaship' ever built set to make its maiden voyage this month.

By The Week Staff Published

-

Holiday season: Fed optimism cheers investors

Holiday season: Fed optimism cheers investorsFeature The feds believe their 'pivot' will make a recession unlikely

By The Week US Published

-

Older workers stay in the labor force

Older workers stay in the labor forceFeature And more of the week's best financial insight

By The Week Staff Published

-

America's most in-demand job

America's most in-demand jobFeature And more of the week's best financial insight

By The Week US Published

-

Currency: the long reign of the mighty dollar

Currency: the long reign of the mighty dollarFeature Argentina is planning to drop the peso in favor of the US dollar

By The Week US Published