The Bank of England under fire for ‘getting its forecasts badly wrong’

Soaring inflation has prompted accusations of economic mismanagement

This year marks the 25th anniversary of the Bank of England’s independence. But the celebrations may be muted in Threadneedle Street, said Russell Lynch in The Daily Telegraph. Uncomfortably for governor Andrew Bailey, the BoE’s silver jubilee coincides “with the greatest test of its credibility in a quarter of a century” – owing to an “inflationary tsunami” critics claim it failed to anticipate. Ahead of this week’s meeting, markets had priced in a 90% chance the Bank would be forced to make its first back-to-back monthly interest rate hike since 2004, taking the base rate from 0.25% to 0.5%. Many are betting on four more hikes this year. Bailey “bristled” when MPs on the Treasury Select Committee suggested he had got the “judgement call” wrong by not acting earlier. “But it is difficult to argue from a position of strength” when inflation, at 5.4%, is nearly treble the Bank’s 2% target, and could possibly run as high as 7% in April.

In fairness, Bailey wasn’t alone in failing to read the inflationary runes, said Alex Brummer in the Daily Mail. In fact, he was “the first central banker of out the blocks” – hiking rates in December when such measures are only now on the way in the US and Europe. And it isn’t really his fault that the British economy now faces a debilitating “double whammy of higher rates and higher taxes” that could knock the recovery for six; the greater blame lies with the Government’s insistence on ploughing ahead with its “fiscal squeeze”. Still, there’s no escaping the fact that the BoE has been “getting its forecasts badly wrong”, with “serious consequences for the management of economic policy”, said Andrew Sentance in The Times. The Monetary Policy Committee’s record has been “chequered” for a decade. “Diversity of debate” has faded away, communication is poor, and there’s been “no clear strategy for normalising UK monetary policy since the global financial crisis”. A “robust review” is urgently needed.

What matters most to the average Briton is what the rate rises will mean for their pockets, said Hugo Duncan in The Mail on Sunday. A hike to, say, 1.5% doesn’t sound too scary, but analysts warn it may come as “a shock” to about ten million British adults who have “never experienced base rates above 1%” – adding £1,300 a year to the cost of a typical mortgage. That’s why a more “measured” rate rise makes sense, said Chris Giles in the FT. The BoE will hope “to shock people into believing it’s serious about bringing inflation down, without having to prescribe the painful medicine of markedly higher borrowing costs”. Tricky to pull off.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

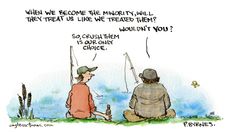

Today's political cartoons - May 4, 2024

Today's political cartoons - May 4, 2024Cartoons Saturday's cartoons - reflections in the pond, riding shotgun, and more

By The Week US Published

-

5 high-caliber cartoons about Kristi Noem shooting her puppy

5 high-caliber cartoons about Kristi Noem shooting her puppyCartoons Artists take on the rainbow bridge, a farm upstate, and more

By The Week US Published

-

The Week Unwrapped: Why is the world running low on blood?

The Week Unwrapped: Why is the world running low on blood?Podcast Scientists believe universal donor blood is within reach – plus, the row over an immersive D-Day simulation, and an Ozempic faux pas

By The Week Staff Published

-

Shein: could the year’s mega-IPO fall apart at the seams?

Shein: could the year’s mega-IPO fall apart at the seams?Talking Point Latest hitch is a pre-float 'security review' that could deter potential investors

By The Week UK Published

-

Labor market strong as inflation sinks

Labor market strong as inflation sinksFeature And more of the week's best financial insight

By The Week US Published

-

Midair blowout: another black mark for Boeing

Midair blowout: another black mark for BoeingFeature This isn't the first production issue Boeing has encountered

By The Week US Published

-

Behemoths of the seas

Behemoths of the seasThe Explainer Cruise liners keep getting bigger, with the world’s largest 'megaship' ever built set to make its maiden voyage this month.

By The Week Staff Published

-

Holiday season: Fed optimism cheers investors

Holiday season: Fed optimism cheers investorsFeature The feds believe their 'pivot' will make a recession unlikely

By The Week US Published

-

Will the UK economy bounce back in 2024?

Will the UK economy bounce back in 2024?Today's Big Question Fears of recession follow warning that the West is 'sleepwalking into economic catastrophe'

By Chas Newkey-Burden, The Week UK Published

-

Older workers stay in the labor force

Older workers stay in the labor forceFeature And more of the week's best financial insight

By The Week Staff Published

-

America's most in-demand job

America's most in-demand jobFeature And more of the week's best financial insight

By The Week US Published