The Future Fund: what the experts think

Back to the future, eclectica and an awkward case study

Back to the future

The idea of government trying to “back winners” fell out of favour in the Thatcher era, said John Harrington on ProactiveInvestors.co.uk. But, along with Keynesian economics, it’s back with a vengeance. This week, the Treasury revealed some of the fruits of the Future Fund scheme – which provided £1.1bn of convertible loans to 1,190 start-ups to help them through the pandemic – listing 158 companies “that have had their loans converted into equity stakes”.

The hope is that these fledgling companies will grow into sound investments, enabling the taxpayer to make a return “later down the line”. If nothing else, it makes a change from the “usual” practice of “bailing out systemically important loss-making companies that have spectacularly failed”.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Eclectica

The list is certainly eclectic, said Kalyeena Makortoff in The Guardian: ranging from Vaccitech, a co-inventor of the AstraZeneca Covid vaccine, to the windfarm company Ripple Energy, to an array of soft drink brands (including the kombucha-maker Better Tasting Drinks). There is also “a bespoke shipbuilder”, a “knitting and crochet supplier”, a ski-wear maker and several events-related businesses, including Secret Cinema and the gig ticketing app Dice FM. Critics may wonder, however, whether all these companies meet Chancellor Rishi Sunak’s stated mission to “transform UK industry, develop new medicines and strengthen our position as a science superpower”.

Awkward case study

Some venture capitalists have complained that the Future Fund scheme “risks misdirecting much-needed capital to the wrong part of the economy”, said CNBC. Others note that what is effectively “one of Europe’s largest venture capital funds” is largely opaque, said James Hurley in The Times. Although the Government has now published the names of the 158 companies it has formally backed, the taxpayer is none the wiser about many of the details. Sunak has acknowledged the potential for embarrassment, and there’s already at least one “awkward case study”. The education start-up Mrs Wordsmith failed less than six months after receiving £650,000 of state cash. One of Mrs Wordsmith’s minor shareholders was Catamaran Ventures UK, “the investment company controlled by Sunak’s wife, Akshata Murthy”.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Create an account with the same email registered to your subscription to unlock access.

-

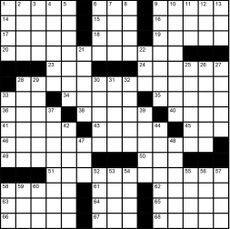

Magazine interactive crossword - April 26, 2024

Magazine interactive crossword - April 26, 2024Puzzles and Quizzes Issue - April 26, 2024

By The Week US Published

-

Magazine solutions - April 26, 2024

Magazine solutions - April 26, 2024Puzzles and Quizzes Issue - April 26, 2024

By The Week US Published

-

Magazine printables - April 26, 2024

Magazine printables - April 26, 2024Puzzles and Quizzes Issue - April 26, 2024

By The Week US Published

-

New austerity: can public services take any more cuts?

New austerity: can public services take any more cuts?Today's Big Question Some government departments already 'in last chance saloon', say unions, as Conservative tax-cutting plans 'hang in the balance'

By The Week UK Published

-

Shein: could the year’s mega-IPO fall apart at the seams?

Shein: could the year’s mega-IPO fall apart at the seams?Talking Point Latest hitch is a pre-float 'security review' that could deter potential investors

By The Week UK Published

-

Labor market strong as inflation sinks

Labor market strong as inflation sinksFeature And more of the week's best financial insight

By The Week US Published

-

Midair blowout: another black mark for Boeing

Midair blowout: another black mark for BoeingFeature This isn't the first production issue Boeing has encountered

By The Week US Published

-

Behemoths of the seas

Behemoths of the seasThe Explainer Cruise liners keep getting bigger, with the world’s largest 'megaship' ever built set to make its maiden voyage this month.

By The Week Staff Published

-

Holiday season: Fed optimism cheers investors

Holiday season: Fed optimism cheers investorsFeature The feds believe their 'pivot' will make a recession unlikely

By The Week US Published

-

Older workers stay in the labor force

Older workers stay in the labor forceFeature And more of the week's best financial insight

By The Week Staff Published

-

America's most in-demand job

America's most in-demand jobFeature And more of the week's best financial insight

By The Week US Published