Meta’s big plunge: ‘Zuck shock’ is a nasty ‘brush with reality’

Why have the social media giant’s shares fallen off a cliff?

No wonder Mark Zuckerberg is so keen on the idea of the metaverse, said Alistair Osborne in The Times. The “real world” can be very hard to bear. More than $230bn was wiped off the value of Meta – parent of Facebook, Instagram and WhatsApp – in a day last week, when the group released full-year figures showing a decline in users for the first time in its 18-year history. The problem, in a nutshell, is that Meta is losing users to TikTok, while Apple’s changes to privacy settings (making it harder to track personal data) will cost Meta $10bn in ad revenues this year. As commentators were quick to note, the $31bn drop in Zuckerberg’s personal fortune was equivalent to the annual GDP of Estonia. All in all, rather a nasty “brush with reality”.

Talk about a “Zuck shock”, said Katie Martin in the FT. The 26% plunge “was the biggest drop in absolute terms in a US company’s market value ever”, and enough to produce the worst day for the whole S&P 500 in more than a year. For years, “those of a more nervous disposition have been concerned about the outsized role Big Tech plays in US markets” – the worry being that “if they hit a bump, they could topple the rest of the market with them”. After last week’s carnage, that fear is no longer so theoretical.

“There comes a time in every great bull market where the dreams of investors collide with the changing facts on the ground,” said The Economist. Far from being “invincible”, Meta comes across “as a business with decelerating growth, a stale core product and a cost-control problem”. Its troubles reflect two kinds of competition. The first is within social media, where the Chinese-owned app TikTok has become a formidable competitor, despite attempts by former president Donald Trump to ban it on national security grounds. The second is the “intensifying contest” between the Big Tech platforms themselves as they diversify into new services. “The narrative of the 2010s – of a series of natural monopolies with an almost effortless dominance over the economy and investment portfolios – no longer neatly reflects reality.” New winners and losers are emerging.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

This has been a week of wild price swings, said James Mackintosh in The Wall Street Journal – as illustrated by Amazon, which, a day after Meta’s big bust, notched up “the biggest market value gain of any US company ever”. These extraordinary moves in Big Tech stocks “in response to small changes in their earnings” shows “what a wacky market we’re in”. Uncertainty about the future of the economy and the tech sector in particular is extremely high. Last week, Meta paid the price.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Today's political cartoons - April 13, 2024

Today's political cartoons - April 13, 2024Cartoons Saturday's cartoons - moderate MAGA, automotive politics, and more

By The Week US Published

-

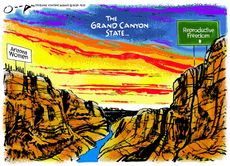

5 Grand Canyon-size cartoons on the Arizona abortion ruling

5 Grand Canyon-size cartoons on the Arizona abortion rulingCartoons Artists take on a chasm in reproductive freedom, the dangers of an abortion ban, and more

By The Week US Published

-

Crossword: April 13, 2024

Crossword: April 13, 2024The Week's daily crossword

By The Week Staff Published

-

Shein: could the year’s mega-IPO fall apart at the seams?

Shein: could the year’s mega-IPO fall apart at the seams?Talking Point Latest hitch is a pre-float 'security review' that could deter potential investors

By The Week UK Published

-

Labor market strong as inflation sinks

Labor market strong as inflation sinksFeature And more of the week's best financial insight

By The Week US Published

-

Midair blowout: another black mark for Boeing

Midair blowout: another black mark for BoeingFeature This isn't the first production issue Boeing has encountered

By The Week US Published

-

Behemoths of the seas

Behemoths of the seasThe Explainer Cruise liners keep getting bigger, with the world’s largest 'megaship' ever built set to make its maiden voyage this month.

By The Week Staff Published

-

Holiday season: Fed optimism cheers investors

Holiday season: Fed optimism cheers investorsFeature The feds believe their 'pivot' will make a recession unlikely

By The Week US Published

-

Older workers stay in the labor force

Older workers stay in the labor forceFeature And more of the week's best financial insight

By The Week Staff Published

-

America's most in-demand job

America's most in-demand jobFeature And more of the week's best financial insight

By The Week US Published

-

Currency: the long reign of the mighty dollar

Currency: the long reign of the mighty dollarFeature Argentina is planning to drop the peso in favor of the US dollar

By The Week US Published