Wealth gap between UK’s richest and poorest ‘turbo-charged’ by the pandemic

New report reveals that household wealth increased by £900bn

Britain’s wealth gap has been “turbo-charged” by the Covid-19 pandemic. According to a report by the Resolution Foundation think tank, total household wealth increased by almost £900bn to £16.5tn – a 6% rise on pre-pandemic levels.

In 2020 the UK suffered its “sharpest economic downturn in more than 300 years”, Reuters says. Despite this the median family saw its wealth rise by £7,800 per adult due to “asset price rises and, to a lesser extent, lower day-to-day spending”. The richest 10% gained £50,000 on average, but the poorest 30% of the population benefited by just £86 per adult.

A lack of spending opportunities and rising house prices meant wealth increased during lockdown, but the “benefits had been skewed to the richest by a ratio of more than 500 to 1”, The Guardian reports.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Jack Leslie, a senior economist at the Resolution Foundation, said the Covid-19 crisis has produced a “highly unusual combination” of a sharp reduction in economic activity, and a sharp increase in household wealth. “Many families have been forced to save rather than spend during lockdowns, while house prices have continued to soar even while working hours have plummeted,” he said.

This is the first time wealth has risen during a recession since the mid-1940s, the report revealed. Total household savings increased by £200bn, household debts (excluding credit cards) decreased by about £10bn, and house prices rose by 8%.

While the total UK wealth had risen by £900bn, the poorest households were more likely to have run down rather than increase their savings. They had “not shared in the house price boom because they were less likely to own a home in the first place”, The Guardian says.

“As a result, the rising wealth gaps that marked pre-pandemic Britain have been turbo-charged by the crisis,” Leslie said. “With policymakers facing many tough decisions in the autumn – from protecting households as unemployment rises to paying for a decent system of social care – they can no longer afford to ignore the dominant role wealth is playing in 21st-century Britain.”

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The Resolution Foundation, which works to improve the lives of people on low to middle incomes, said the findings of its study should cause the government to “rethink its decision” to scrap the £20-a-week increase to universal credit in September.

Mubin Haq, chief executive of Standard Life Foundation, which supported the study, said the rise in wealth for those at the bottom “has been paltry even taking into account the £20-a-week increase in universal credit payments to those on the lowest incomes”. The announcement of the cut to universal credit risks “further widening the wealth divide which ballooned during the pandemic”.

Create an account with the same email registered to your subscription to unlock access.

-

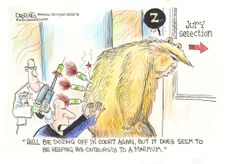

Today's political cartoons - April 20, 2024

Today's political cartoons - April 20, 2024Cartoons Saturday's cartoons - papal ideas, high-powered debates, and more

By The Week US Published

-

5 sleeper hit cartoons about Trump's struggles to stay awake in court

5 sleeper hit cartoons about Trump's struggles to stay awake in courtCartoons Artists take on courtroom tranquility, war on wokeness, and more

By The Week US Published

-

The true story of Feud: Capote vs. The Swans

The true story of Feud: Capote vs. The SwansIn depth The writer's fall from grace with his high-flying socialite friends in 1960s Manhattan is captured in a new Disney+ series

By Adrienne Wyper, The Week UK Published

-

Britishvolt: how Britain’s bright battery hope was zapped

Britishvolt: how Britain’s bright battery hope was zappedfeature Battery-making startup’s demise ‘has thrown up tales of reckless spending’ and incompetence

By The Week Staff Published

-

Sam Bankman-Fried: the arrest of the disgraced crypto crusader

Sam Bankman-Fried: the arrest of the disgraced crypto crusaderfeature The founder of the failed crypto exchange FTX was arrested on Monday

By The Week Staff Published

-

The UK’s migration ‘surge’ examined

The UK’s migration ‘surge’ examinedfeature 1.1 million people migrated to the UK last year, according to the latest ONS data

By The Week Published

-

Why UK companies are facing a dystopian, zero-growth future

Why UK companies are facing a dystopian, zero-growth futurefeature In prioritising stability, the Treasury risks ‘stifling enterprise and entrepreneurship’

By The Week Staff Published

-

UK builders: drawing a line under the cladding crisis?

UK builders: drawing a line under the cladding crisis?feature Michael Gove’s threat to builders may be paying off

By The Week Staff Published

-

Travel is back: is the UK aviation industry ready for the big take-off?

Travel is back: is the UK aviation industry ready for the big take-off?feature After two years of chaos caused by Covid-19, airports and airlines are now hit by a staffing crisis

By Mike Starling Published

-

National Lottery operating licence: and the winner is…

National Lottery operating licence: and the winner is…feature Camelot has ‘outlasted five prime ministers’, but following a hotly contested bidding process, it has finally been toppled

By The Week Staff Published

-

Big brand boycotts in Russia: who is in and who is out?

Big brand boycotts in Russia: who is in and who is out?feature Hundreds of Western companies have pulled out of Russia, but some remain

By The Week Staff Published