Food inflation: a headache for CEOs and consumers alike

Soaring inflation is hitting big companies such as Unilever

The consumer goods market is facing its fiercest inflationary pressures in a decade. That, said Judith Evans in the FT, was the message last week from Unilever – whose brands range from Hellmann’s mayonnaise to Magnum ice cream to Domestos bleach. Chief executive Alan Jope said “very material cost increases”, for packaging, transport and particularly raw materials, were squeezing its profit margins. The price of palm oil was up 70% from the first half of last year, he said, while soybean oil was up by 80% and crude oil by 60%.

Inflation, it seems, is “becoming as much a headache for CEOs of household staples companies as for shoppers”, said Carol Ryan in The Wall Street Journal. Margins are hurting. Unilever’s shares fell 5% on the announcement because, despite improved sales, “operating margins are expected to be flat in 2021”. Bernstein analysts recently estimated that Unilever and its main European peer Nestlé face roughly 14% increases in bills over the next 12 months. Prices of individual ingredients such as soybean oil are rising even faster. Should the company try and absorb these costs or pass them on? And to whom? It’s an ethically fraught question. Consumers in emerging markets have less disposable income on average than those in mature economies, but it’s easier to hike prices there since supermarkets in developing countries have “less bargaining power than in Europe and the US”. Consumer bosses thus “face a delicate balancing act” to get through this year with their margins, market share and reputations intact.

“Anxiety that inflation is about to gut the economy” is all around, said Bloomberg. “At the White House. In consumer data. On earnings calls.” Roughly 87% of S&P 500 companies that released earnings in July mentioned inflation. The only places apparently immune to the angst are the stock and bond markets, where investors have taken Fed chairman Jerome Powell’s mantra that the current level of inflation is “transitory” to heart.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

If the rising price of coffee – hit by a shortage of containers – is anything to go by, “trouble is brewing in America”, said The Economist. Yet “transport logjams and paltry harvests in producing regions” have “conspired with surging demand to stoke food inflation across the smorgasbord”. The UN Food and Agriculture Organisation expects the value of global food imports to reach nearly $1.9trn this year – up from $1.6trn in 2019. “In May, its index of main soft commodities hit its highest value since 2011.” Price spikes could feed broader inflation – already rising in many countries – which would be bad for consumers. But their loss is a gain for “big agriculture” and the giant companies that source and ship foodstuffs. There’s always a winner somewhere.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

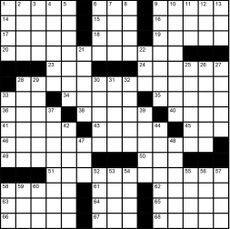

Magazine interactive crossword - April 26, 2024

Magazine interactive crossword - April 26, 2024Puzzles and Quizzes Issue - April 26, 2024

By The Week US Published

-

Magazine solutions - April 26, 2024

Magazine solutions - April 26, 2024Puzzles and Quizzes Issue - April 26, 2024

By The Week US Published

-

Magazine printables - April 26, 2024

Magazine printables - April 26, 2024Puzzles and Quizzes Issue - April 26, 2024

By The Week US Published

-

Shein: could the year’s mega-IPO fall apart at the seams?

Shein: could the year’s mega-IPO fall apart at the seams?Talking Point Latest hitch is a pre-float 'security review' that could deter potential investors

By The Week UK Published

-

Labor market strong as inflation sinks

Labor market strong as inflation sinksFeature And more of the week's best financial insight

By The Week US Published

-

Midair blowout: another black mark for Boeing

Midair blowout: another black mark for BoeingFeature This isn't the first production issue Boeing has encountered

By The Week US Published

-

Behemoths of the seas

Behemoths of the seasThe Explainer Cruise liners keep getting bigger, with the world’s largest 'megaship' ever built set to make its maiden voyage this month.

By The Week Staff Published

-

Holiday season: Fed optimism cheers investors

Holiday season: Fed optimism cheers investorsFeature The feds believe their 'pivot' will make a recession unlikely

By The Week US Published

-

Older workers stay in the labor force

Older workers stay in the labor forceFeature And more of the week's best financial insight

By The Week Staff Published

-

America's most in-demand job

America's most in-demand jobFeature And more of the week's best financial insight

By The Week US Published

-

Currency: the long reign of the mighty dollar

Currency: the long reign of the mighty dollarFeature Argentina is planning to drop the peso in favor of the US dollar

By The Week US Published