Britain’s ‘astronomical’ inflation rise in five charts

Analysts warn that prices will continue to rise beyond the next 12 months

The National Institute of Economic and Social Research (NIESR) think tank has warned that inflation will soar to “astronomical” levels over the next year.

Real wages in the UK have dipped as inflation has soared over the past few months, leaving households out of pocket as they face huge rises in energy bills and the cost of everyday products.

People are “terrified and exhausted” by forecasts of “runaway inflation”, with some concerned about “falling into increasing debt”, said The Independent’s Jane Dalton. Citizens Advice has warned that the support it is giving out is “growing at record-breaking levels”, and thousands of people have started using foodbanks as supermarket price tags have soared.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

More people are also picking up additional work to help cover costs, with Uber reporting an “all-time high” in the number of people driving for the car service company, said the BBC. The data provides a fuller picture of what’s going on.

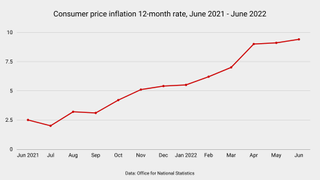

1. Inflation

According to the Office for National Statistics (ONS), annual consumer price inflation rose to 9.4% in June, the highest recorded since February 1982. A 42% increase year-on-year in petrol prices and an almost 10% increase in food prices dealt a “hammer blow for families on low incomes” that month, said Reuters.

The NIESR said that the “astronomical levels” of inflation coming over the next year will force the Bank of England “to raise interest rates higher and for longer than previously expected”, said The Guardian.

The think tank predicted that inflation could rise to 11% before the end of this year, while the retail price index could hit 17.7%. The Bank is expected to raise interest rates tomorrow in “its largest single increase since 1995”, said CNBC.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Data collated by KPMG and the British Retail Consortium has indicated that retail sales are falling “at a pace not seen since the worst months of the pandemic”, said the Financial Times (FT).

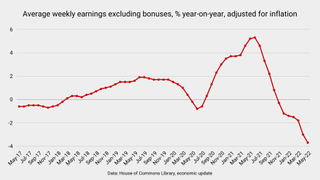

2. Real wages

Increases in inflation mean that “pay is now clearly falling in real terms both including and excluding bonuses”, David Freeman, head of labour market and household statistics for the ONS, warned last month.

“The spending power of UK households fell the most in at least 21 years” in June, said Bloomberg, “as wage increases were eaten up by the fastest inflation in decades”. Figures from the ONS show “how pay packets for most workers are failing to benefit from the tightest labour market in living memory”.

The NIESR warned that average incomes will fall by 2.5% this year, “leaving millions of families to use saving or expensive credit” throughout winter, said The Guardian.

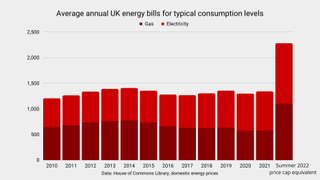

3. Energy bills

Energy consultancy Cornwall Insights has warned “there is little relief in sight for households struggling with soaring electricity and gas costs”, said the FT. The firms’ analysts forecast that Britain’s energy price cap will be “significantly” above an average £3,000 a year until “at least 2024”.

Money Saving Expert Martin Lewis told the BBC that the expected rises will “throw many households into a terribly difficult financial situation”, and that for some, things will be “desperate” during the winter months. He warned that some people could be forced into making “awful choices”.

Craig Lowrey, principal consultant at Cornwall Insight, said that the “duration” of the energy cap rise is what “makes these new forecasts so devastating”. The warnings have “triggered fresh pleas” from fuel poverty campaigners and politicians to increase financial aid for households, said the FT.

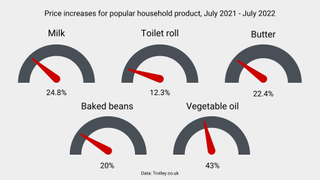

4. Popular goods

The costs of many common household goods have soared in recent months, and the “gloomy stats lay bare the sheer scale of the cost-of-living crunch”, said The Sun. The price of Lurpak spread “skyrocketed” in UK supermarkets last month, with instances of a 1kg tub being sold for more than £9, reported the i news site.

Retail analysts told the news site that the rising price of oil “could be to blame” for the surge in butter prices. The market “has been strangled since Vladimir Putin invaded Ukraine”. The rising price of fertiliser could also be a reason for the price hike.

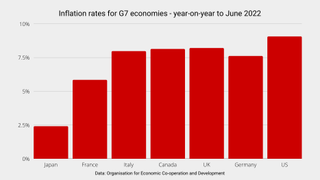

Consumer price inflation hit a “40-year high” in May, the highest of the G7 countries, said CNN Business – and “worse is likely to come”. However, “smaller European countries” are seeing even faster inflation increases.

Financial advisers Boolers said that the “perfect storm of issues” has pushed the UK inflation to the highest level seen for decades.

Disruption caused by the pandemic and China’s “zero Covid” policy have “pushed up freight prices and caused costly delays”, said The Guardian, while companies are struggling to combat worker shortages. Firms are also facing “additional costs” as a result of Brexit, with “reams of paperwork and border delays adding to the pressure”.

Create an account with the same email registered to your subscription to unlock access.

-

'Good riddance to the televised presidential debate'

'Good riddance to the televised presidential debate'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

Caitlin Clark the No. 1 pick in bullish WNBA Draft

Caitlin Clark the No. 1 pick in bullish WNBA DraftSpeed Read As expected, she went to the Indiana Fever

By Peter Weber, The Week US Published

-

Today's political cartoons - April 16, 2024

Today's political cartoons - April 16, 2024Cartoons Tuesday's cartoons - sleepyhead, little people, and more

By The Week US Published

-

Feds cap credit card late fees at $8

Feds cap credit card late fees at $8speed read The Consumer Financial Protection Bureau finalized a rule to save households an estimated $10 billion a year

By Peter Weber, The Week US Published

-

Nigeria's economic woes: what went wrong for African nation

Nigeria's economic woes: what went wrong for African nationUnder the radar President Tinubu is struggling to tackle soaring inflation after 'shock therapy' of ending fuel subsidies

By Richard Windsor, The Week UK Published

-

Geopolitics and the economy in 2024

Geopolitics and the economy in 2024Talking Point The West is banking on a year of falling inflation. Don't rule out a shock

By The Week UK Published

-

How did America avoid a recession in 2023?

How did America avoid a recession in 2023?Today's Big Question A downturn was inevitable. Until it wasn't.

By Joel Mathis, The Week US Published

-

What rising gold prices can tell us about the economy in 2024

What rising gold prices can tell us about the economy in 2024The Explainer Market hits all-time high, boosted by a weakening US dollar and rising global tensions

By Flora Neville, The Week UK Published

-

Inflation vs. deflation: which is worse for national economies?

Inflation vs. deflation: which is worse for national economies?Today's Big Question Lower prices may be good news for households but prolonged deflation is ‘terrible for the economy’

By The Week Staff Published

-

Interest rates: more ‘trauma’ for households

Interest rates: more ‘trauma’ for householdsTalking Point Latest hike will cause ‘plenty of pain for borrowers’

By The Week Staff Published

-

Interest rates rise to 5.25% for first time in 15 years

Interest rates rise to 5.25% for first time in 15 yearsSpeed Read Inflation is slowing but at 7.9% it remains well above the Bank of England’s 2% target

By Julia O'Driscoll Published