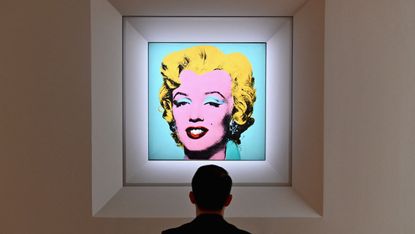

Warhol’s Blue Marilyn breaks records: art investment market is ‘on a roll’

Art, like gold, can claim a history as ‘a store of value’, but big caveats apply

Blue Marilyn

This year’s spring auction season in New York was billed as a key test of the health of the art market, said DealBook in The New York Times – “an indication of whether top-quality trophies can continue to command high prices, no matter the instability of the world”. The “bellwether” work kicking off proceedings was Andy Warhol’s 1964 silk-screen of Marilyn Monroe, Shot Sage Blue Marilyn, which sold for $195m – breaking records as both “the highest auction price ever for an American artist” and the most expensive 20th century work. That was taken as a good omen, amid the current “surfeit of blue-chip art”. As Philip Hoffman of advisory firm The Fine Art Group observed, “there’s been a huge amount held back for two years, and there’s a huge amount of pent-up demand from new clients”. He reckons Manhattan’s two-week auction marathon could raise $2bn.

Four-minute wonder

The iconic Marilyn painting, one of a series of portraits Warhol made of the Hollywood star after her death in 1962, was sold “in just under four minutes”, said Waiyee Yip on Insider. Christie’s called it a tribute to Warhol’s “pervasive power”. The painting was bought by mega-dealer Larry Gagosian, who declined to say whether he was acting for himself or a client. But Asian bidding was notably “thin” throughout the sale, said Katya Kazakina on Artnet – “the Hong Kong salesroom was quiet when the Marilyn came up” and “Middle Eastern bidders didn’t seem to materialise either”.

Inflation hedge?

“Stocks, bonds and crypto are in turmoil. But more tangible assets are on a roll,” said Lex in the FT. An old football shirt – “admittedly worn by Maradona when he scored the world’s most memorable goal” – recently fetched over £7m. Art, like gold, can claim a history as “a store of value”. Indeed, Sotheby’s Mei Moses Index suggests that “over the long term” it has beaten inflation. But big caveats apply. Paintings are illiquid assets, prone “to more subjective impulses than gold or even houses”. With borrowing increasingly funding purchases, the art market has also benefited from low interest rates. Warhol’s Blue Marilyn might look like “the perfect kitschy inflation hedge”. But appearances can be deceptive.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Create an account with the same email registered to your subscription to unlock access.

-

Who actually needs life insurance?

Who actually needs life insurance?The Explainer If you have kids or are worried about passing on debt, the added security may be worth it

By Becca Stanek, The Week US Published

-

Sexual wellness trends to know, from products and therapies to retreats and hotels

Sexual wellness trends to know, from products and therapies to retreats and hotelsThe Week Recommends Talking about pleasure and sexual health is becoming less taboo

By Theara Coleman, The Week US Published

-

Is the AI bubble deflating?

Is the AI bubble deflating?Today's Big Question Growing skepticism and high costs prompt reconsideration

By Joel Mathis, The Week US Published

-

Shein: could the year’s mega-IPO fall apart at the seams?

Shein: could the year’s mega-IPO fall apart at the seams?Talking Point Latest hitch is a pre-float 'security review' that could deter potential investors

By The Week UK Published

-

Labor market strong as inflation sinks

Labor market strong as inflation sinksFeature And more of the week's best financial insight

By The Week US Published

-

Midair blowout: another black mark for Boeing

Midair blowout: another black mark for BoeingFeature This isn't the first production issue Boeing has encountered

By The Week US Published

-

Behemoths of the seas

Behemoths of the seasThe Explainer Cruise liners keep getting bigger, with the world’s largest 'megaship' ever built set to make its maiden voyage this month.

By The Week Staff Published

-

Holiday season: Fed optimism cheers investors

Holiday season: Fed optimism cheers investorsFeature The feds believe their 'pivot' will make a recession unlikely

By The Week US Published

-

Older workers stay in the labor force

Older workers stay in the labor forceFeature And more of the week's best financial insight

By The Week Staff Published

-

America's most in-demand job

America's most in-demand jobFeature And more of the week's best financial insight

By The Week US Published

-

Currency: the long reign of the mighty dollar

Currency: the long reign of the mighty dollarFeature Argentina is planning to drop the peso in favor of the US dollar

By The Week US Published