Enter the bear: how long will the carnage last?

Investors are grappling with a nasty bear market

Investors initially acted with relief when the US Fed raised its main interest rate by 0.5 percentage points last week, even though it was “the first rise of that magnitude in more than two decades”, said the FT. The thinking was: it could have been worse. Fed chairman Jay Powell appeared to rule out an even larger rise of 0.75% for now. But it wasn’t long before “market bullishness” again gave way to nerves about how far borrowing costs would have to rise to tackle runaway inflation. The familiar “whipsaw” pattern reasserted itself: “strong rallies on some days, but even sharper sell-offs on others, as puzzled investors tried to position themselves for the end of easy-money policies”.

Wall Street has now “endured its worst run of weekly losses in more than a decade – six in a row”, said The Trader in Investors Chronicle. And, as yet, this bear market looks very far from turning. The rout is increasingly global, said Russell Hotten in The Times. Indices across the world “sank deep into the red” earlier this week as worries about China’s falling growth, and the economic fallout of the Ukraine war, combined with concerns over whether central banks can tame inflation “without tipping the world’s largest economies into recession”. Even “diversified” portfolios are unsafe in the current environment, said The Economist. “In America, investing 60% in stocks and 40% in bonds produced an annual average return of 11% from 2008 to 2021.” That strategy has lost 10% this year. “Whereas 2021 marked the apex of the ‘everything rally’, in which most asset prices rose, 2022 could mark the start of an ‘everything slump’.”

The big question is how much lower the US S&P 500 might fall, said Will Daniel in Fortune. The good news, according to Bank of America strategist Michael Hartnett, is that “bear markets are quicker than bull markets”. Based on data gleaned from the last 19 of them, he reckons the S&P 500 “still has another roughly 25% downturn ahead of it from current levels”. The bottom, he suggests, might be hit in October – though “a floor does not equal a new bull market for tech stocks”, which are likely to “remain in a bear market for the next two years”. A lot of speculation has already been flushed out of the market, which is “healthy”, said John Authers on Bloomberg. But ultimately this is about economics. “If inflation comes under control relatively quickly and the world escapes without a dose of stagflation, then it will be that much easier to justify paying up for stocks”. But if the economy “moves to the worse end of expectations, with negative growth and higher inflation”, expect the falls to continue. It’s not the cheeriest of messages.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

'Republicans want to silence Israel's opponents'

'Republicans want to silence Israel's opponents'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

Poland, Germany nab alleged anti-Ukraine spies

Poland, Germany nab alleged anti-Ukraine spiesSpeed Read A man was arrested over a supposed Russian plot to kill Ukrainian President Zelenskyy

By Peter Weber, The Week US Published

-

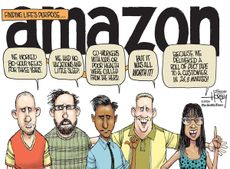

Today's political cartoons - April 19, 2024

Today's political cartoons - April 19, 2024Cartoons Friday's cartoons - priority delivery, USPS on fire, and more

By The Week US Published

-

Controversy is brewing over a lawsuit involving Hermès' luxury bags

Controversy is brewing over a lawsuit involving Hermès' luxury bagsTalking Point The lawsuit alleges the company only sells bags to people with a 'sufficient purchase history'

By Justin Klawans, The Week US Published

-

What RFK Jr.'s running mate pick says about his candidacy

What RFK Jr.'s running mate pick says about his candidacyTalking Points Robert F. Kennedy Jr.'s' running mate brings money and pro-abortion-rights cred to his longshot presidential bid

By Harold Maass, The Week US Published

-

Chinese electric cars may be coming to spy on you

Chinese electric cars may be coming to spy on youTalking Points The Biden administration investigates Chinese electric cars as a potential economic and national security threat

By Harold Maass, The Week US Published

-

Is this the end of the big night out?

Is this the end of the big night out?Talking Point Bar closures and Gen Z teetotallers threaten 'extinction' for 'messy nights on the town'

By Chas Newkey-Burden, The Week UK Published

-

Did the Biden impeachment inquiry just collapse?

Did the Biden impeachment inquiry just collapse?Talking Points Key GOP impeachment inquiry witness Alexander Smirnov says Russian intelligence fed him lies

By Harold Maass, The Week US Published

-

Japan is no longer the world's third-biggest economy despite its stock market peaking

Japan is no longer the world's third-biggest economy despite its stock market peakingTalking Point The country was overtaken by Germany after unexpectedly entering a recession

By Justin Klawans, The Week US Published

-

How the world economy learned to live with the drama

How the world economy learned to live with the dramaUnder the Radar As economists predict a 'soft landing' after recent crises, is the global economy now 'oblivious to the new world disorder'?

By Elliott Goat, The Week UK Published

-

What Elon Musk has to fear from China's 'Tesla killer'

What Elon Musk has to fear from China's 'Tesla killer'Talking Points BYD is now the world's biggest seller of electric vehicles

By Joel Mathis, The Week US Published