Trading currencies: what the experts think

Euro-parity, a nasty cocktail and the pound’s ‘doom loop’

Euro-parity?

Prepare for a big shake-up in the currency stakes, said Alice Gledhill on Bloomberg. For the first time in two decades, the euro “is on the verge of US dollar parity”. The EU’s common currency hit a five-year low of near $1.03 last week – “buckling from a rush into the greenback as a haven from market turmoil”. And plenty of analysts predict the two currencies will hit parity in 2022. “Hedge funds are already betting on it”: they’ve piled $7bn into “options wagers on parity” in the past month alone.

Nasty cocktail

Although the euro’s plight is largely “a function of dollar strength” – which has been “supercharged” as the US Fed presses on with big interest-rate hikes – the “darkening outlook for the European economy” doesn’t help. Not everyone is negative. Roberto Mialich of UniCredit expects the euro to climb back above $1.10 next year as the Fed’s hiking cycle tails off. But that looks a long shot. The European Central Bank “is walking a tightrope”, said Alice Gledhill, attempting to balance the need “to tame record inflation” against “the economic damage that could cause” – especially in the bloc’s most indebted member states, such as Italy. “We find it hard to see a silver lining for the single currency at this stage,” noted HSBC, pointing to downward revisions to growth forecasts and upward revisions for inflation. “This is a nasty cocktail for any currency to try to digest.”

The pound’s ‘doom loop’

We know all about that in Britain, said Liam Halligan in The Sunday Telegraph. The pound has lost a tenth of its value against the dollar this year, as the cost-of-living crisis has escalated. It is “now close to the psychologically important $1.20 benchmark”. Could it also be heading for dollar parity? Given the speed of the recent falls, it can’t be ruled out. “Sterling is now at risk of falling into ‘a doom loop’ – in which a lower pound results in more expensive imports, adding to upward price pressure. The resulting rise in inflation then pushes the pound down even more, creating a downward spiral.” The Bank of England claims it can’t do much about the global energy and food prices. “But if decisive rate rises help prevent sterling’s fall, they would help hugely in efforts to rein in rampant inflation.”

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Interest rate cut: the winners and losers

Interest rate cut: the winners and losersThe Explainer The Bank of England's rate cut is not good news for everyone

-

Quiz of The Week: 3 – 9 May

Quiz of The Week: 3 – 9 MayHave you been paying attention to The Week's news?

-

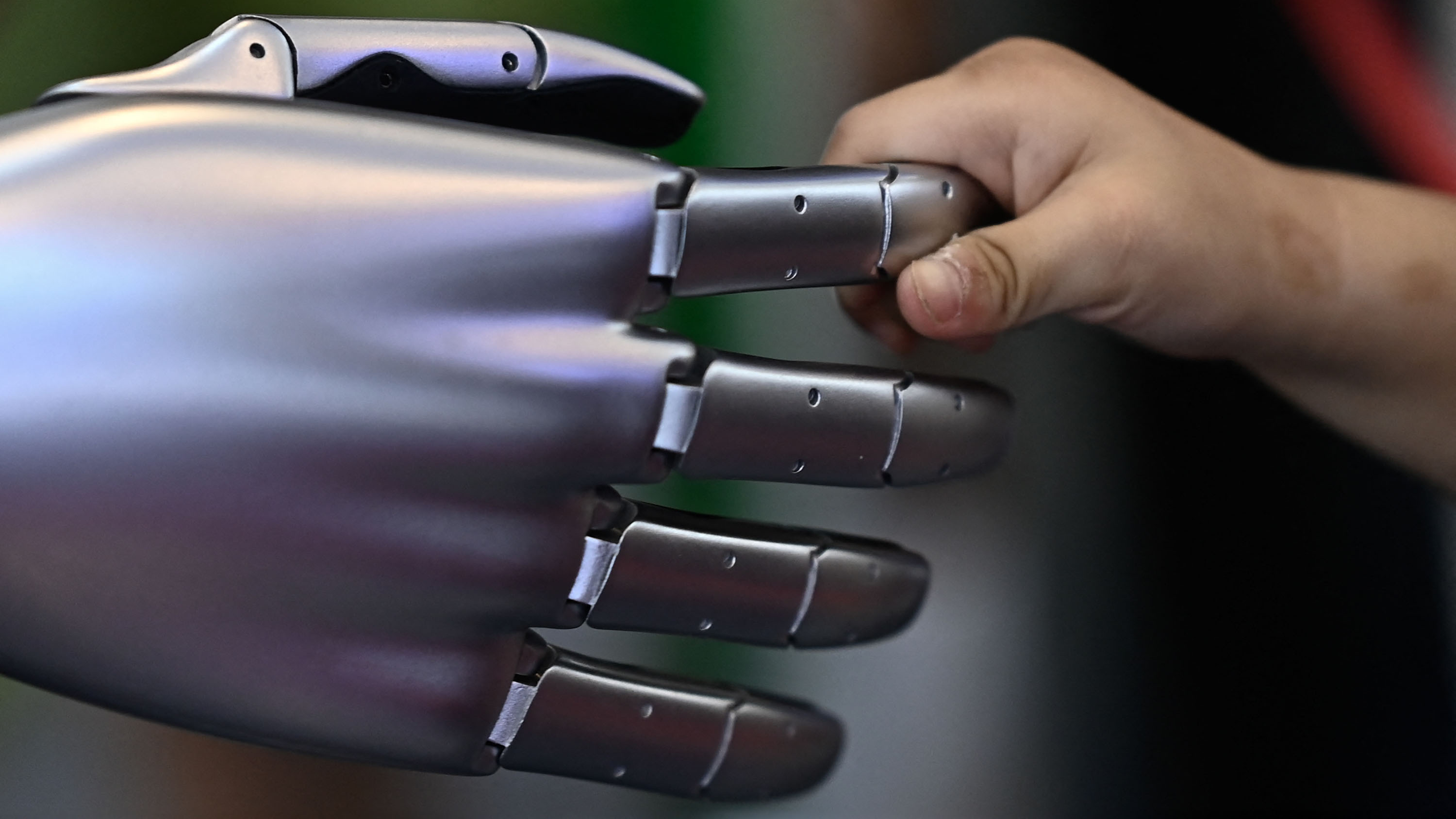

The Week Unwrapped: Will robots benefit from a sense of touch?

The Week Unwrapped: Will robots benefit from a sense of touch?Podcast Plus, has Donald Trump given centrism a new lease of life? And was it wrong to release the deadly film Rust?

-

Work life: Caution settles on the job market

Work life: Caution settles on the job marketFeature The era of job-hopping for bigger raises is coming to an end as workers face shrinking salaries and fewer opportunities to move up

-

Saving the post office

Saving the post officeFeature The U.S. Postal Service is facing mounting losses and growing calls for privatization. Can it survive?

-

Safe harbor: Gold rises as stocks sink

Safe harbor: Gold rises as stocks sinkfeature It's a golden age for goldbugs

-

What is the Mar-a-Lago accord?

What is the Mar-a-Lago accord?Talking Point A Maga economic blueprint proposes upending the global financial system. Could it fly?

-

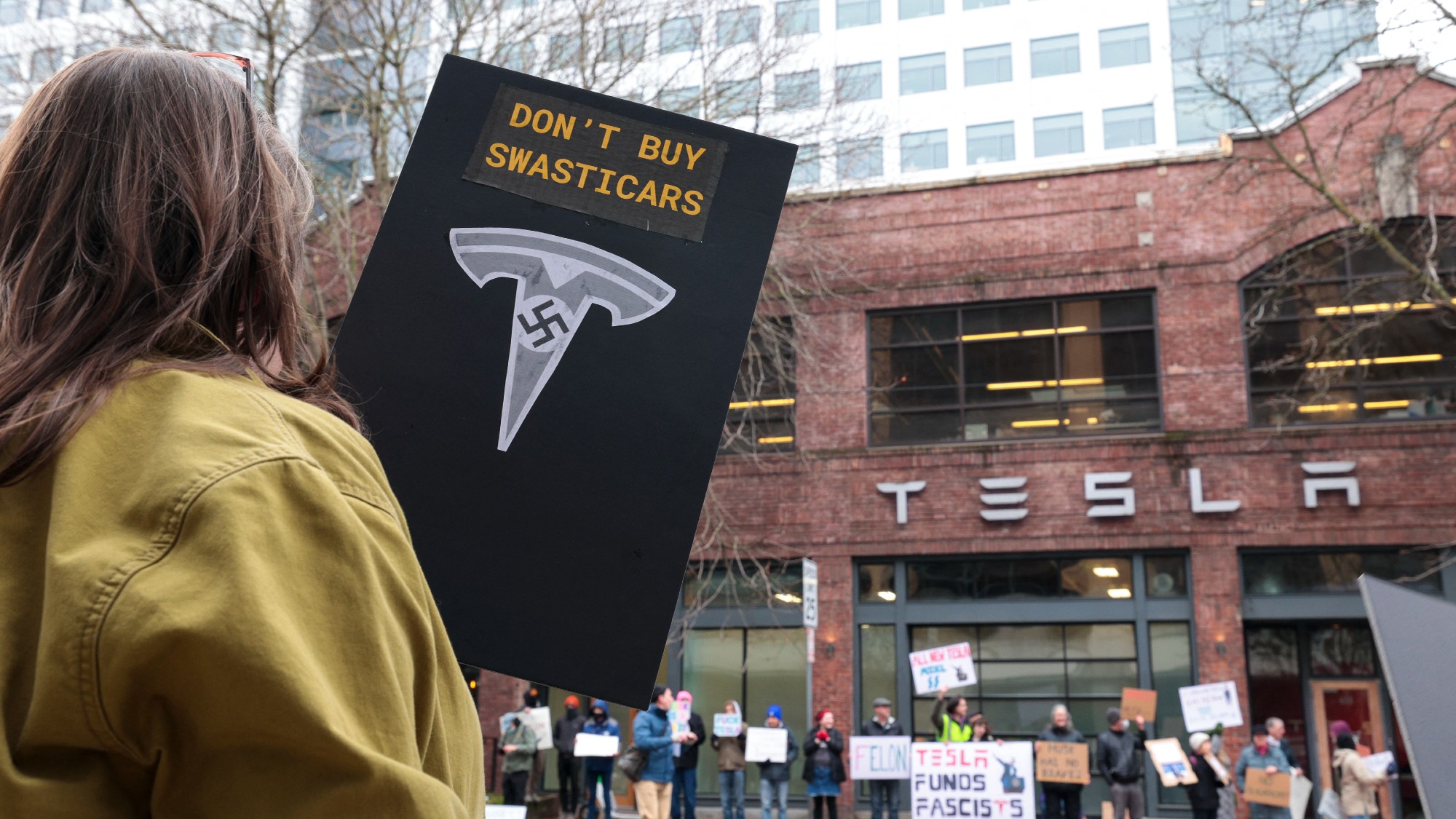

Elon Musk: has he made Tesla toxic?

Elon Musk: has he made Tesla toxic?Talking Point Musk's political antics have given him the 'reverse Midas touch' when it comes to his EV empire

-

Texas vs. Delaware: See you in court

Texas vs. Delaware: See you in courtFeature Delaware risks losing its corporate dominance as companies like Tesla and Meta consider reincorporating in Texas

-

Trade wars, explained

Trade wars, explainedThe Explainer Free trade is almost always good for any economy – so why is it so unpopular?

-

Diversity training: a victim of the 'war on woke'

Diversity training: a victim of the 'war on woke'Talking Point More and more US companies have phased out corporate DEI initiatives, and the incoming Trump administration is likely to fuel the cultural shift