Bitcoin price: is the ‘crypto winter’ finally over?

Cryptocurrency reaches 12-month peak as bull market continues

The cryptocurrency market’s bumper year showed no signs of stopping at the weekend as bitcoin and its rivals saw considerable gains.

According to the ranking website CoinMarketCap, bitcoin values sat at around $7,850 (£6,200) on Friday morning, before comfortably trending above the $8,000 (£6,310) mark over the course of the weekend.

However, values leapt by some $500 (£394) between 8pm and 9pm on Sunday evening, bringing the bitcoin’s price per coin up to $8,670 (£6,850) during the early hours of Monday morning, the ranking site reports.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

As of 9am UK time, CoinMarketCap puts bitcoin values at around $8,730 (£6,890) per coin.

The cryptocurrency is on a 12-month high thanks to the gains it made over the weekend. Values have also risen by 70% since the beginning of May and by a “whopping” 120% compared to prices at the start of this year, says Forbes.

Sunday’s spike, meanwhile, saw the digital coin’s market capitalisation (the combined value of all bitcoins) rise by $15bn (£11.8bn), resulting in gains of $20bn (£15.8bn) across “the wider cryptocurrency market”, the news site says.

Despite the gains, bitcoin is still some way behind its all-time peak value recorded in December 2017. At the time, the virtual currency came close to hitting $20,000 (£15,770) before suffering continual losses over the 12 months that followed.

Is the ‘crypto winter’ over?

Perhaps. Although bitcoin is still some way behind its record highs, the market’s gains over the weekend has led one expert to believe that the market’s struggles in 2018 are unlikely to be repeated any time soon.

In an interview with the Financial Times, Manuel Ernesto De Luque Muntaner, founder of the Luxembourg-based crypto investment fund Block Asset Management, said that many people thought that cryptocurrencies as a whole were “gone” following last year’s “crypto winter”.

But he said that an increased demand among “institutional buyers and venture capital funds” has helped boost the market in recent months.

Meanwhile, The Daily Telegraph says that bitcoin is becoming more widely accepted by retailers, with US-based supermarket Whole Foods and mobile network company AT&T confirming in recent weeks that they are “prepared to accept” the cryptocurrency.

It’s also believed that the reward for creating bitcoins – known as mining – will decrease next May, which “will squeeze the supply of the cryptocurrency and in theory push up its price”, the newspaper says.

How did bitcoin’s rivals fare?

Well. It’s not only bitcoin that has benefited from the bull market.

The second largest cryptocurrency behind bitcoin, Ethereum, leapt from a low of $235 (£185) on Friday to today’s value of $270 (£213), according to CoinMarketCap.

The banking-focused digital coin Ripple, which is ranked third, also saw prices climb over the weekend. Values were recorded at around $0.38 (£0.30) on Monday, before rising to a high of $0.47 (£0.37) today, says the ranking site.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

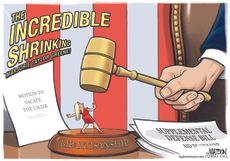

Aid to Ukraine: too little, too late?

Aid to Ukraine: too little, too late?Talking Point House of Representatives finally 'met the moment' but some say it came too late

By The Week UK Published

-

5 generously funny cartoons on the $60 billion foreign aid package

5 generously funny cartoons on the $60 billion foreign aid packageCartoons Artists take on Republican opposition, aid to Ukraine, and more

By The Week US Published

-

Knife: Salman Rushdie's 'mesmeric memoir' of brutal attack

Knife: Salman Rushdie's 'mesmeric memoir' of brutal attackThe Week Recommends The author's account of ordeal which cost him his eye is both 'scary and heartwarming'

By The Week Staff Published

-

Sam Bankman-Fried found guilty: where does crypto go from here?

Sam Bankman-Fried found guilty: where does crypto go from here?Today's Big Question Conviction of the 'tousle-haired mogul' confirms sector's 'Wild West' and 'rogue' image, say experts

By Chas Newkey-Burden, The Week UK Published

-

Does looming FTX collapse spell the end of crypto?

Does looming FTX collapse spell the end of crypto?Today's Big Question Fall of the embattled cryptocurrency-exchange platform has sent shockwaves through the industry

By Fred Kelly Published

-

How DAOs work – and why they matter

How DAOs work – and why they matterfeature Everything you need to know about the major new cryptocurrency trend

By Kate Samuelson Published

-

Millionaire ‘mugged’ of bitcoin fortune by masked raiders

Millionaire ‘mugged’ of bitcoin fortune by masked raidersfeature Co-founder of ‘Spanish Facebook’ says he was tortured into revealing cryptocurrency passwords

By The Week Staff Published

-

Bitcoin price: values show signing of recovery following slump

Bitcoin price: values show signing of recovery following slumpIn Depth Cryptocurrencies are making gains despite crackdown by China

By The Week Staff Published

-

Bitcoin price: why the digital coin is suffering its biggest fall in six months

Bitcoin price: why the digital coin is suffering its biggest fall in six monthsIn Depth Total of $170bn has been wiped from the virtual currency market since June

By The Week Staff Published

-

Bitcoin price: is the market heading for a ‘perfect storm’?

Bitcoin price: is the market heading for a ‘perfect storm’?In Depth Low interest from investors could spell trouble for online crypto traders

By The Week Staff Published

-

Bitcoin price: crypto market falls into ‘chaos’ as Facebook Libra delays loom

Bitcoin price: crypto market falls into ‘chaos’ as Facebook Libra delays loomIn Depth Market drops by 20% in a matter of hours as analysts blame ‘technical issues’

By The Week Staff Published