Bitcoin price: why has the cryptocurrency’s value nosedived?

Some analysts are predicting a bull run later this year

Bitcoin prices nosedived once again over the weekend following a month of gains, stalling the cryptocurrency’s recovery.

Values had risen from a low of $3,400 (£2,600) per coin on 8 February to Friday morning’s peak price of $4,190 (£2,005), according to ranking site CoinMarketCap.

But the virtual currency’s values plummeted suddenly on Friday afternoon, with about $400 wiped off the price of each bitcoin in the space of an hour, the website reports. As of 9am UK time today, the price sat at about $3,830 (£2,930).

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Bitcoin rivals including Etherum and Ripple also saw declines of around 5% over the weekend, Forbes reports.

Although the cause of the market’s sudden downturn was “not immediately apparent”, the drop may be the result of “traders and investors profit-taking and flooding the market with surplus digital tokens”, the business news site says.

The Daily Express notes that there is still a “widespread apathy in terms of open interest” around bitcoin, despite a boost to the market earlier this month when banking giant J.P. Morgan announced it was launching its own internal cryptocurrency.

“There’s still a huge amount of uncertainty around cryptocurrencies, and that is being reflected in market movement,” the newspaper says.

Despite the latest setbacks, some analysts are hopeful that the virtual coin will bounce back this year.

As cryptocurrency news site CoinDesk points out, the current market trend is very similar to bitcoin’s fluctuating values in early 2015. Back then, bitcoin entered a bull run in October, and experts believe the virtual currency may follow the same path in late 2019.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

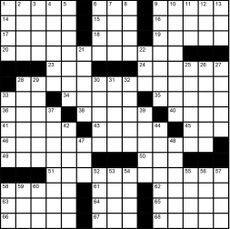

Magazine interactive crossword - April 26, 2024

Magazine interactive crossword - April 26, 2024Puzzles and Quizzes Issue - April 26, 2024

By The Week US Published

-

Magazine solutions - April 26, 2024

Magazine solutions - April 26, 2024Puzzles and Quizzes Issue - April 26, 2024

By The Week US Published

-

Magazine printables - April 26, 2024

Magazine printables - April 26, 2024Puzzles and Quizzes Issue - April 26, 2024

By The Week US Published

-

Sam Bankman-Fried found guilty: where does crypto go from here?

Sam Bankman-Fried found guilty: where does crypto go from here?Today's Big Question Conviction of the 'tousle-haired mogul' confirms sector's 'Wild West' and 'rogue' image, say experts

By Chas Newkey-Burden, The Week UK Published

-

Does looming FTX collapse spell the end of crypto?

Does looming FTX collapse spell the end of crypto?Today's Big Question Fall of the embattled cryptocurrency-exchange platform has sent shockwaves through the industry

By Fred Kelly Published

-

How DAOs work – and why they matter

How DAOs work – and why they matterfeature Everything you need to know about the major new cryptocurrency trend

By Kate Samuelson Published

-

Millionaire ‘mugged’ of bitcoin fortune by masked raiders

Millionaire ‘mugged’ of bitcoin fortune by masked raidersfeature Co-founder of ‘Spanish Facebook’ says he was tortured into revealing cryptocurrency passwords

By The Week Staff Published

-

How cybercriminals are hacking into the heart of the US economy

How cybercriminals are hacking into the heart of the US economySpeed Read Ransomware attacks have become a global epidemic, with more than $18.6bn paid in ransoms in 2020

By The Week Staff Last updated

-

Language-learning apps speak the right lingo for UK subscribers

Language-learning apps speak the right lingo for UK subscribersSpeed Read Locked-down Brits turn to online lessons as a new hobby and way to upskill

By Mike Starling Published

-

Brexit-hobbled Britain ‘still tech powerhouse of Europe’

Brexit-hobbled Britain ‘still tech powerhouse of Europe’Speed Read New research shows that UK start-ups have won more funding than France and Germany combined over past year

By Mike Starling Published

-

Playing Cupid during Covid: Tinder reveals Britain’s top chat-up lines of the year

Playing Cupid during Covid: Tinder reveals Britain’s top chat-up lines of the yearSpeed Read Prince Harry, Meghan Markle and Dominic Cummings among most talked-about celebs on the dating app

By Joe Evans Last updated