RBS: how to split it up and save money on expensive bankers

Sell off the good bits, and you won't need a big bonus master of the universe to look after what's left

NOT FOR the first time, one has to wonder how David Cameron would get on without Ed Miliband to help him. By forcing Stephen Hester to turn down his £1 million pound bonus, the Labour leader has extricated the Prime Minister from a row which even many of his staunchest supporters thought he was badly mishandling.

The prospect of a Commons vote on the package, which would surely have been lost, must have horrified the PM every bit as much as it clearly did Hester himself. Yet one of the most extraordinary things about the RBS chief's pay, given that he works for a publicly owned concern, is that no outsider seems to know how much he is actually getting.

Some reports at the weekend claimed he might have made as much as £35 million so far for his stint at the troubled bank, while others said that even if he turned down the £1 million (as he now has) he was still in line for different bonuses worth several times as much.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

What does not seem to have occurred to either the Government or its critics is that, the way RBS is going, Hester may work himself out of a job sooner than they suppose. If this does happen it will not be because the bank has miraculously come right, but because the mission he originally embarked on has – through no fault of his own – turned out to be impossible.

Back in 2008, when RBS was rescued, the expectation was that it could be returned to the private sector in relatively short order and possibly even at a profit. Ironically, in view of the latest row, much of the value that Labour ministers at the time hoped to recover for the taxpayer was reckoned to reside in its investment bank and other City operations.

But as the economy stubbornly refuses to revive, and banks around the Western world continue to shrink, plans have had to change. Abroad, RBS's activities are being slimmed right back, while at home the investment bank is being radically pruned on the orders of the Chancellor.

The venerable stock-broking arm, Hoare Govett, is about to be sold for "a nominal sum". Next up are likely to be the profitable insurance operations, including Direct Line, Churchill and Green Flag, which have to go by the end of next year under the terms of its bail-out agreement with the EU.

Once they are sold, RBS will be reduced to a collection of largely domestic, comparatively humdrum businesses. The danger then will be that it lingers on as a zombie, unable to shake off its toxic legacy of boom time loans, and dragging down the economy for years, if not decades to come.

To avoid that, it might well be best to split what is left into good and bad components, as the Irish have done with their banks and as the Treasury has here with Northern Rock. This would mean that the taxpayer gets landed with having to work through the dud loans. But we have effectively got those already, and at least the viable parts could be refloated and help restore the flow of credit to businesses and consumers.

From a political point of view, splitting it would also have the advantage that what remains should no longer need the services of a big bonus master of the universe. A traditional bank manager would be much more the ticket – and much cheaper, too.

At the Irish bad bank, NAMA, which has so far been charged with disposing of some 70 billion euros of dodgy debt, the boss is on 430,000 euros a year. Not only has he foregone any bonus for the last two years, but he has also just agreed to accept a 15 per cent reduction in his basic salary for the coming one, out of solidarity with his compatriots.

In this country, the head of UK Asset Realisation Ltd, which has taken on the bulk of Northern Rock's old loan book as well as that of the Bradford and Bingley, does better, but not that much. In its first year he received a total package, including bonus, pension and allowances, of just over £550,000.

No one disputes that Stephen Hester is doing a good job. But the job is changing, and that could well throw up the opportunity to get it done for less. It is the sort of point a razor-sharp investment banker would grasp in a nanosecond.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

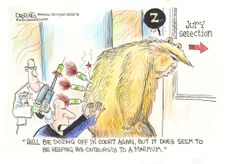

5 sleeper hit cartoons about Trump's struggles to stay awake in court

5 sleeper hit cartoons about Trump's struggles to stay awake in courtCartoons Artists take on courtroom tranquility, war on wokeness, and more

By The Week US Published

-

The true story of Feud: Capote vs. The Swans

The true story of Feud: Capote vs. The SwansIn depth The writer's fall from grace with his high-flying socialite friends in 1960s Manhattan is captured in a new Disney+ series

By Adrienne Wyper, The Week UK Published

-

Scottie Scheffler: victory for the 'pre-eminent golfer of this era'

Scottie Scheffler: victory for the 'pre-eminent golfer of this era'Why Everyone's Talking About Masters victory is Scheffler's second in three years

By The Week Staff Published

-

Do Tory tax cuts herald return of austerity?

Do Tory tax cuts herald return of austerity?Today's Big Question Chancellor U-turns on scrapping top rate tax but urges ministers to make public spending cuts

By Elliott Goat Published

-

Why the government opposes a windfall tax on oil and gas profits

Why the government opposes a windfall tax on oil and gas profitsfeature BP profit surge triggers renewed calls for a levy to help struggling households

By The Week Staff Published

-

NatWest and RBS trial new fingerprint bank cards

NatWest and RBS trial new fingerprint bank cardsSpeed Read Biometric payment system will allow customers to spend more than £30 using contactless cards

By The Week Staff Last updated

-

Two-thirds of Brits still don’t trust banks

Two-thirds of Brits still don’t trust banksSpeed Read Ten years on from the financial crisis, survey finds trust for banking system in short supply

By The Week Staff Last updated

-

What is Britain’s worst bank?

What is Britain’s worst bank?Speed Read Royal Bank of Scotland comes joint-bottom in the new personal banking league table, and last for business banking

By The Week Staff Last updated

-

RBS set for biggest privatisation in UK history

RBS set for biggest privatisation in UK historySpeed Read US regulators impose $4.9bn penalty and pave way for Government to sell its 70% stake

By The Week Staff Last updated

-

RBS to cut 162 branches and 792 jobs

RBS to cut 162 branches and 792 jobsSpeed Read Move comes days after taxpayer-owned bank announced 206% rise in profits

By The Week Staff Last updated

-

RBS memo to ‘let customers hang themselves’ sparks fury

RBS memo to ‘let customers hang themselves’ sparks furySpeed Read Ex-MP says callous banking tactics following 2008 crash drove small business owners to suicide

By The Week Staff Last updated