British Gas: D-day looms large for owner, Centrica

Competition probe one of many challenges for utility giant, which has had to slash its dividend

by Steven Frazer, Shares magazine

Energy group Centrica will soon to find out just how sharp are the teeth of the Competition and Markets Authority (CMA). The watchdog has been investigating the UK gas and electricity supply industry for several months, amid allegations of excessive profits and market abuse. The CMA will release its provisional findings tomorrow, and the report could have wide-reaching implications for the British Gas-owner, and one of the UK's 'big six' suppliers.

'The CMA has the power to impose significant change on the market although how far it will actually go is extremely uncertain,' says Cantor Fitzgerald utilities analyst Adam Forsyth. 'It may even conclude that there is nothing to do.' Recent speculation suggest the latter may be close to the truth. A Financial Times article recently suggested that the big six UK energy retailers are likely to be cleared of accusations of excessive profits and market abuse.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

British Gas's market share is estimated at 30.2 per cent of the UK dual fuel market, with around 7.3 million customers. That's twice the size of the next biggest competitor, SSE, and provides clear evidence that the fewer changes to the status quo the CMA suggests, the better Centrica will like it.

But the company faces other challenges, such as low wholesale gas prices, climate change issues, new competition and emerging technology. After the warmest year of record (2014) and a stunning collapse in oil and gas prices, annual profit slumped by more than a third in 2014, while operating profit at British Gas fell 20 per cent to £823 million, causing the group to slash its dividend by 30 per cent.

Trading in the early part of 2015 has seemingly improved, according to a trading update on 27 April that flagged a 10 per cent rise in gas consumption, partly due to cooler than usual temperatures. Yet these limited improvements will be more than offset by lower commodity prices.

With capital investment and production costs being squeezed, chief executive Iain Conn faces increasing pressure to find long-term solutions to the group's many problems. Some City analysts even think there is a real chance of a dramatic break-up of its upstream supply and downstream production assets. Conn is expected to reveal the findings of his own group-wide strategic review alongside half-year results due on 30 July.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Today's political cartoons - April 20, 2024

Today's political cartoons - April 20, 2024Cartoons Saturday's cartoons - papal ideas, high-powered debates, and more

By The Week US Published

-

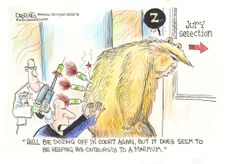

5 sleeper hit cartoons about Trump's struggles to stay awake in court

5 sleeper hit cartoons about Trump's struggles to stay awake in courtCartoons Artists take on courtroom tranquility, war on wokeness, and more

By The Week US Published

-

The true story of Feud: Capote vs. The Swans

The true story of Feud: Capote vs. The SwansIn depth The writer's fall from grace with his high-flying socialite friends in 1960s Manhattan is captured in a new Disney+ series

By Adrienne Wyper, The Week UK Published

-

Is it time for Britons to accept they are poorer?

Is it time for Britons to accept they are poorer?Today's Big Question Remark from Bank of England’s Huw Pill condemned as ‘tin-eared’

By Chas Newkey-Burden Published

-

Brits to be told how to save energy

Brits to be told how to save energySpeed Read Have showers not baths, turn down radiators and lower boiler temperatures, the government will advise

By Sorcha Bradley Published

-

Why the ‘energy price cap’ is confusing – and how it could be better communicated

Why the ‘energy price cap’ is confusing – and how it could be better communicatedfeature Government assumptions over public’s energy illiteracy doing more harm than good

By The Week Staff Published

-

US angered by Opec+ oil cut

US angered by Opec+ oil cutSpeed Read Energy prices to rise further as producers slash supply by two million barrels a day

By Fred Kelly Published

-

Water bill discounts: the customers due to save money

Water bill discounts: the customers due to save moneyfeature Watchdog orders Thames Water and Southern Water among others to repay millions to customers for missing targets

By The Week Staff Last updated

-

Will UK firms survive the winter?

Will UK firms survive the winter?Today's Big Question New government support package will cap wholesale energy costs for UK businesses for six months

By The Week Staff Published

-

Will pumping more oil and gas solve the energy crisis?

Will pumping more oil and gas solve the energy crisis?Today's Big Question Experts say boosting domestic supplies is ‘unlikely to tame super-high prices’ in immediate term

By Elliott Goat Published

-

How bad will the energy crisis get and what is being done?

How bad will the energy crisis get and what is being done?Business Briefing Inflation is predicted to hit 18.6% in January, and energy bills are soaring

By The Week Staff Published