Quantitative easing in the eurozone - how does it work?

The ECB is has announced a huge programme of money-creation - but what does that actually mean?

The European Central Bank (ECB) has announced a massive programme of quantitative easing (QE) for the eurozone today. The idea is to fight low inflation - and stave off the spectre of deflation.

Expectations were so high that there were warnings of "serious disappointment in financial markets" if a programme was not announced, says the BBC's Andrew Walker. In the end those fears were ungrounded as the ECB announced it would purchase €60bn of bonds per month until the end of September 2016 at least - "far more than previously expected", according to the BBC.

There have been warnings that deflation - both a symptom and a cause of economic decline - could reignite the eurozone's debt crisis, says Walker. And ECB president Mario Draghi is worried that cheaper oil could lead to what he calls the "second round effects" of deflation.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

These include consumers holding-off from purchases because they expect prices to keep getting lower, and companies firing staff to cut costs and dropping prices further still in their efforts to encourage people to spend.

QE offers a solution: by buying government debts using specially-created money, the ECB can perhaps get the eurozone economies moving again. It works because buying large quantities of bonds can raise their price, which then lowers the return investors make on them.

The investors are mostly financial institutions. Lower returns should lead to them reducing interest rates, which in turn should encourage businesses to invest more and consumers to spend more.

The ECB has tried QE before - as have the UK and US in recent years - but this time it is likely to be on a bigger scale than we have seen before, says Walker.

UBS chairman Axel Weber yesterday said he expected the ECB to announce a "sizeable programme" of QE but warned it was "only part of the fix", says the Financial Times.

Weber said the danger was that the more the ECB does to help, the less pressure governments will feel to act. He insisted that governments "need to deliver policy reforms" - in other words, cut spending and implement austerity programmes.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

'Republicans want to silence Israel's opponents'

'Republicans want to silence Israel's opponents'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

Poland, Germany nab alleged anti-Ukraine spies

Poland, Germany nab alleged anti-Ukraine spiesSpeed Read A man was arrested over a supposed Russian plot to kill Ukrainian President Zelenskyy

By Peter Weber, The Week US Published

-

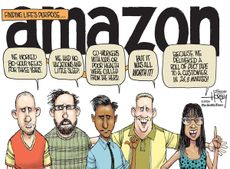

Today's political cartoons - April 19, 2024

Today's political cartoons - April 19, 2024Cartoons Friday's cartoons - priority delivery, USPS on fire, and more

By The Week US Published

-

Puffed rice and yoga: inside the collapsed tunnel where Indian workers await rescue

Puffed rice and yoga: inside the collapsed tunnel where Indian workers await rescueSpeed Read Workers trapped in collapsed tunnel are suffering from dysentery and anxiety over their rescue

By Sorcha Bradley, The Week UK Published

-

Gaza hospital blast: What the video evidence shows about who's to blame

Gaza hospital blast: What the video evidence shows about who's to blameSpeed Read Nobody wants to take responsibility for the deadly explosion in the courtyard of Gaza's al-Ahli Hospital. Roll the tape.

By Peter Weber, The Week US Published

-

Giraffe poo seized after woman wanted to use it to make a necklace

Giraffe poo seized after woman wanted to use it to make a necklaceTall Tales And other stories from the stranger side of life

By Chas Newkey-Burden, The Week UK Published

-

Helicopter sound arouses crocodiles

Helicopter sound arouses crocodilesTall Tales And other stories from the stranger side of life

By Chas Newkey-Burden, The Week UK Published

-

Woman sues Disney over 'injurious wedgie'

Woman sues Disney over 'injurious wedgie'Tall Tales And other stories from the stranger side of life

By Chas Newkey-Burden, The Week UK Published

-

Emotional support alligator turned away from baseball stadium

Emotional support alligator turned away from baseball stadiumTall Tales And other stories from the stranger side of life

By Chas Newkey-Burden, The Week UK Published

-

Europe's oldest shoes found in Spanish caves

Europe's oldest shoes found in Spanish cavesTall Tales And other stories from the stranger side of life

By Chas Newkey-Burden, The Week UK Published

-

Artworks stolen by Nazis returned to heirs of cabaret performer

Artworks stolen by Nazis returned to heirs of cabaret performerIt wasn't all bad Good news stories from the past seven days

By The Week Staff Published