Why Croatia is writing off the debt of its poorest citizens

Government 'proud' to give thousands of people the chance 'for a new start without a burden of debt'

The government in Croatia is to cancel the debts of its poorest citizens in an attempt to boost the economy.

The unprecedented move will give up to 600,000 citizens the "chance for a new start without a burden of debt", the country's deputy prime minister, Milanka Opacic, told a cabinet meeting.

The programme was launched following a government deal with the country's largest banks, telecommunications operators and public utility companies, who will not be refunded for their losses.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

"I can't think of anything comparable," Dean Baker, co-director of the Washington-based Center for Economic and Policy Research, told the Washington Post.

In order to be eligible for the cancellation, citizens will have to have debt that is lower than 35,000 kuna (£3,400) and a monthly income of less than 1,250 kuna (£122) or be on welfare. Applicants are also not allowed to own any property or have savings.

"This is the first time that any [Croatian] government [has] tried to solve this difficult problem and we are proud of it," said Croatian prime minister Zoran Milanovic.

Croatia has suffered a recession for six years in a row and its unemployment rate has doubled to 19.6 per cent since it joined the EU in 2013. The programme is expected to cost up to 2.1 billion kuna (£212m), but the social-democratic government believes the significant short-term investment will have long-term benefits as the country begins spending again.

However, the move has been dismissed by some as sheer "populism" ahead of parliamentary elections later this year, Bloomberg reports. "Obviously, the recent victory of an opposition politician in the presidential elections last month has concentrated the mind of PM Milanovic on the need to come up with some vote winning policies, " said Timothy Ash chief economist of London-based Standard Bank.

Others are unsure if the scheme will even succeed. "I am not sure that this is the best way to help low-income people. If lenders think this can happen again they will charge very high interest rates to low-income borrowers," Baker said.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

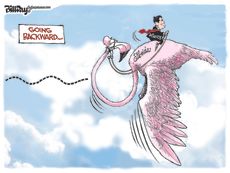

Today's political cartoons - April 15, 2024

Today's political cartoons - April 15, 2024Cartoons Monday's cartoons - flamingos in flight, taxes, and more

By The Week US Published

-

Empty-nest boomers aren't selling their big homes

Empty-nest boomers aren't selling their big homesSpeed Read Most Americans 60 and older do not intend to move, according to a recent survey

By Peter Weber, The Week US Published

-

Trump's first criminal trial starts with jury picks

Trump's first criminal trial starts with jury picksSpeed Read The former president faces charges related to hush money payments made to adult film star Stormy Daniels

By Peter Weber, The Week US Published

-

Labour shortages: the ‘most urgent problem’ facing the UK economy right now

Labour shortages: the ‘most urgent problem’ facing the UK economy right nowSpeed Read Britain is currently in the grip of an ‘employment crisis’

By The Week Staff Published

-

Will the energy war hurt Europe more than Russia?

Will the energy war hurt Europe more than Russia?Speed Read European Commission proposes a total ban on Russian oil

By The Week Staff Published

-

Will Elon Musk manage to take over Twitter?

Will Elon Musk manage to take over Twitter?Speed Read The world’s richest man has launched a hostile takeover bid worth $43bn

By The Week Staff Last updated

-

Shoppers urged not to buy into dodgy Black Friday deals

Shoppers urged not to buy into dodgy Black Friday dealsSpeed Read Consumer watchdog says better prices can be had on most of the so-called bargain offers

By The Week Staff Published

-

Ryanair: readying for departure from London

Ryanair: readying for departure from LondonSpeed Read Plans to delist Ryanair from the London Stock Exchange could spell ‘another blow’ to the ‘dwindling’ London market

By The Week Staff Published

-

Out of fashion: Asos ‘curse’ has struck again

Out of fashion: Asos ‘curse’ has struck againSpeed Read Share price tumbles following the departure of CEO Nick Beighton

By The Week Staff Published

-

Universal Music’s blockbuster listing: don’t stop me now…

Universal Music’s blockbuster listing: don’t stop me now…Speed Read Investors are betting heavily that the ‘boom in music streaming’, which has transformed Universal’s fortunes, ‘still has a long way to go’

By The Week Staff Published

-

EasyJet/Wizz: battle for air supremacy

EasyJet/Wizz: battle for air supremacySpeed Read ‘Wizz’s cheeky takeover bid will have come as a blow to the corporate ego’

By The Week Staff Published