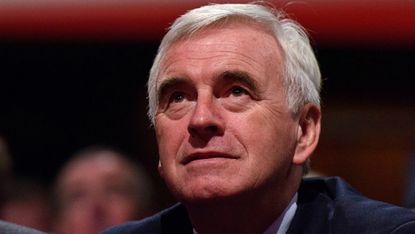

Labour says 'Robin Hood tax' would raise £26bn

Shadow chancellor John McDonnell says new levy would help NHS, but critics warn it could hurt pensioners and cost jobs

Labour is continuing to clarify how it will fund tens of billions of pounds of spending pledges if it wins the election, confirming today its support for a so-called "Robin Hood tax".

Shadow chancellor John McDonnell says the tax would raise around £5bn a year and £26bn in total over the next parliament.

This would help to pay for a host of new commitments, including today's announcement that the party would spend another £37bn on the NHS over the course of the next five years, including on IT system upgrades.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The concept of a financial transactions tax evolved out of ideas for a tax on short-term currency trades in the 1970s. It has gained popularity since the financial crisis.

A popular campaign for a Robin Hood tax would see a tiny levy of 0.05 per cent applied to all transactions to raise "£250bn a year globally".

Labour's tax is higher at 0.5 per cent and is effectively an extension of a stamp duty that already applies to purchases of listed company shares.

"Labour's estimate of £4.7bn in revenue for 2016/17 is predicated on a tax rate of 0.2 per cent of the value of transactions for banks, hedge funds and other financial companies, and 0.5 per cent for non-financial businesses," says the Financial Times.

McDonnell said: "We bailed out the City 10 years ago when the crash came, we poured hundreds of billions of pounds into it. Since then £100bn has been given out in bonuses in the City.

"So we are asking for a small contribution...to fund our public services."

Several think-tanks have "warned that pensioners and savers with investments would be hit as much as bankers, while the public would face higher interest rates as a result," says the Daily Telegraph.

Julian Jessop, chief economist at the Institute of Economic Affairs, says: "The increased costs would inevitably be passed on to customers, including small investors, in the form of higher charges, and to borrowers in the form of higher interest rates.

"Non-financial firms will find it more expensive to raise capital and manage risk, which will undermine the economy further.

"In reality, it's always ordinary people who ultimately pay, including consumers and workers. Sherwood Forest wasn't made of magic money trees either.”

Labour's own Sadiq Khan, who is the mayor of London where most of the affected UK financial transactions would take place, has previously called such a levy "madness".

The BBC says concern over the tax would add to worries over a loss of business from the City in the wake of Brexit.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

'Horror stories of women having to carry nonviable fetuses'

'Horror stories of women having to carry nonviable fetuses'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

Haiti interim council, prime minister sworn in

Haiti interim council, prime minister sworn inSpeed Read Prime Minister Ariel Henry resigns amid surging gang violence

By Peter Weber, The Week US Published

-

Today's political cartoons - April 26, 2024

Today's political cartoons - April 26, 2024Cartoons Friday's cartoons - teleprompter troubles, presidential immunity, and more

By The Week US Published

-

Labour shortages: the ‘most urgent problem’ facing the UK economy right now

Labour shortages: the ‘most urgent problem’ facing the UK economy right nowSpeed Read Britain is currently in the grip of an ‘employment crisis’

By The Week Staff Published

-

Will the energy war hurt Europe more than Russia?

Will the energy war hurt Europe more than Russia?Speed Read European Commission proposes a total ban on Russian oil

By The Week Staff Published

-

Will Elon Musk manage to take over Twitter?

Will Elon Musk manage to take over Twitter?Speed Read The world’s richest man has launched a hostile takeover bid worth $43bn

By The Week Staff Last updated

-

Shoppers urged not to buy into dodgy Black Friday deals

Shoppers urged not to buy into dodgy Black Friday dealsSpeed Read Consumer watchdog says better prices can be had on most of the so-called bargain offers

By The Week Staff Published

-

Ryanair: readying for departure from London

Ryanair: readying for departure from LondonSpeed Read Plans to delist Ryanair from the London Stock Exchange could spell ‘another blow’ to the ‘dwindling’ London market

By The Week Staff Published

-

Out of fashion: Asos ‘curse’ has struck again

Out of fashion: Asos ‘curse’ has struck againSpeed Read Share price tumbles following the departure of CEO Nick Beighton

By The Week Staff Published

-

Universal Music’s blockbuster listing: don’t stop me now…

Universal Music’s blockbuster listing: don’t stop me now…Speed Read Investors are betting heavily that the ‘boom in music streaming’, which has transformed Universal’s fortunes, ‘still has a long way to go’

By The Week Staff Published

-

EasyJet/Wizz: battle for air supremacy

EasyJet/Wizz: battle for air supremacySpeed Read ‘Wizz’s cheeky takeover bid will have come as a blow to the corporate ego’

By The Week Staff Published