Pound soars as investors ‘bet on Conservative election win’

Economist declares that 12 December vote is Boris Johnson’s to lose

Increasing conviction that the Conservatives will win a majority in the 12 December general election has apparently caused sterling to jump to its highest level since May against the dollar and the euro.

The pound bought $1.31 on Thursday morning, while the euro rate moved above €1.18.

“Markets view a healthy Tory majority as the best outcome for UK risk assets, at least in the short term, as it would lead to an orderly withdrawal from the EU at the end of January following years of uncertainty,” explains the Financial Times.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Traders are betting on a Conservative victory, says the newspaper, although several investors have warned the currency is now vulnerable to any tightening of the polls.

The latest YouGov survey, which ended on 3 December, gave the Tories a nine-point lead over Labour.

“The election is Boris Johnson’s to lose,” Dean Turner, an economist at UBS Wealth Management, told the FT yesterday.

Joshua Mahony, a senior market analyst at the spread betting firm IG, added: “While we have seen gains for the Labour party, there is a feeling that it may be too little too late, as we stand just eight-days from election day.

“From a market standpoint, a Conservative majority would likely come with a sharp surge in the pound, and thus the upside we are seeing in sterling reflects the market willingness to take on some risk with a view to getting into this GB pound trade early.”

–––––––––––––––––––––––––––––––For a round-up of the most important business stories and tips for the week’s best shares - try The Week magazine. Get your first six issues free–––––––––––––––––––––––––––––––

The performance of the pound against the dollar was observed by The Wall Street Journal, which said Sterling “trimmed its post-Brexit referendum losses against the greenback to 13%, from about 18% in the immediate aftermath of the 2016 vote. Before the referendum, the pound hovered at around $1.50.”

Kenneth Broux, a currency strategist at Societe Generale, said: “In terms of cable (sterling/dollar) and euro/sterling, we’ve been trading at $1.30 and 85 pence respectively in the last few weeks and not managed to break through until today.

“Technically these are important levels. I think some investors may be saying to themselves, well you know what, the polls haven’t changed much so let’s put a bit more money on the table, add to long sterling positions.”

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

William Gritten is a London-born, New York-based strategist and writer focusing on politics and international affairs.

-

'Elevating Earth Day into a national holiday is not radical — it's practical'

'Elevating Earth Day into a national holiday is not radical — it's practical'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

UAW scores historic win in South at VW plant

UAW scores historic win in South at VW plantSpeed Read Volkswagen workers in Tennessee have voted to join the United Auto Workers union

By Peter Weber, The Week US Published

-

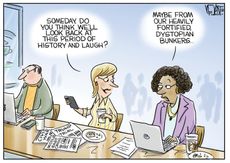

Today's political cartoons - April 22, 2024

Today's political cartoons - April 22, 2024Cartoons Monday's cartoons - dystopian laughs, WNBA salaries, and more

By The Week US Published

-

Weak pound: how to avoid losing out on holiday

Weak pound: how to avoid losing out on holidaySpeed Read As the value of the pound continues to drop, holiday goers face higher prices

By The Week Staff Last updated

-

Pound falls to lowest level in 27 months amid no-deal panic

Pound falls to lowest level in 27 months amid no-deal panicSpeed Read Currency sinks after both Tory leadership hopefuls declare backstop ‘dead’

By The Week Staff Last updated

-

Brexit coin: what would it feature and how much could it fetch?

Brexit coin: what would it feature and how much could it fetch?Speed Read Treasury minister backs commemorative series after Royal Mail blocks Brexit stamp

By The Week Staff Published

-

Rare £1 coins: how to find the most valuable ones

Rare £1 coins: how to find the most valuable onesSpeed Read Treasure seekers look for flawed £1 coins after numerous ‘mistakes’ fetch huge prices

By The Week Staff Last updated

-

How new Conservative policies will affect your wallet

How new Conservative policies will affect your walletIn Depth Attitudes to wealth and benefits may have helped decide the election. Here's what the Tory win means for personal finance

By The Week Staff Published