Why are global stock markets plunging?

Asian markets slide as US Nasdaq index sees largest loss in seven years

Global stocks continued to slide this morning as a selling frenzy swept across markets from the US to Japan, fuelled by factors including trade tensions from the US-China trade war, worries about slowing economic growth and a massive drop in tech shares.

The Nasdaq - the world’s second-largest stock exchange in terms of market capitalisation - bore the brunt of the sell-off of tech stocks including Apple, Microsoft and Google owner Alphabet. By the time trading drew to a close last night, the tech-heavy exchange had fallen by 4.4%, its largest one-day drop in seven years.

Meanwhile, the Dow Jones shed more than 600 points, while the S&P 500 Index fell by 3.1% - erasing all of the gains for 2018 in both markets, reports CNBC.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

“Against a backdrop of rising interest rates and growing trade tensions, a feeling that the best days of the economic cycle were in the past was taking hold,” says the Financial Times.

European tech stocks were also hit by the global sell-off. The Europe-wide Stoxx 600 fell by 1%, while London’s FTSE 100 lost 1.1%.

Asian investors joined in the market rout, with South Korea’s Kospi index and Japan’s Topix on track to record their worst numbers since the 2008 financial crisis.

Asian stocks have now lost almost $5trn this year, according to Bloomberg. The MSCI Asia Pacific Index - a broad measure of stocks across the region - had dropped by around 2% as of Thursday afternoon, “taking its slide from a January peak to 22%”, the news site reports.

However, leading investment firm Nomura Asset Management believes the Asian downturn is temporary, as “Chinese companies are in strong financial shape and have the capacity to buy back shares and boost dividends”, Bloomberg adds.

When it comes to the global scene, Kelvin Tay, regional chief investment officer at UBS Wealth Management in Singapore, says that a host of factors are contributing to poor sentiment, including “rising rates, weak third-quarter corporate results, tensions in the European Union over the Italian fiscal stand-off and Brexit, and US-China trade concerns”.

“The market is trying to decide if the solid global economic fundamentals we’ve had till now are starting to give way to a period of weaker growth,” he said.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Italian senate passes law allowing anti-abortion activists into clinics

Italian senate passes law allowing anti-abortion activists into clinicsUnder The Radar Giorgia Meloni scores a political 'victory' but will it make much difference in practice?

By Chas Newkey-Burden, The Week UK Published

-

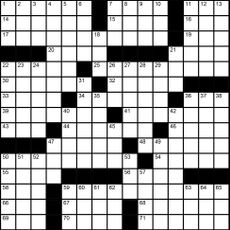

Magazine interactive crossword - May 3, 2024

Magazine interactive crossword - May 3, 2024Puzzles and Quizzes Issue - May 3, 2024

By The Week US Published

-

Magazine solutions - May 3, 2024

Magazine solutions - May 3, 2024Puzzles and Quizzes Issue - May 3, 2024

By The Week US Published

-

Why Reddit is going public

Why Reddit is going publicThe Explainer The 'front page of the internet' is facing criticism for the decision as well as its valuation

By Chas Newkey-Burden, The Week UK Published

-

Litquidity: the financial ‘meme-lord’ taking Wall Street by storm

Litquidity: the financial ‘meme-lord’ taking Wall Street by stormWhy Everyone’s Talking About Instagram’s most popular financial meme account is the creation of an anonymous former banker

By Sorcha Bradley Published

-

2020 stock market predictions

2020 stock market predictionsSpeed Read Will this year see global markets consolidate 2019’s record gains?

By The Week Staff Last updated

-

Why are US markets hitting record highs?

Why are US markets hitting record highs?Speed Read Optimism over trade deal progress even took the Dow Jones up

By The Week Staff Last updated

-

US stock market hits record high on trade war optimism

US stock market hits record high on trade war optimismSpeed Read S&P touches new heights as Trump says phase one will be signed earlier than thought

By The Week Staff Last updated

-

FTSE hits nine-month high as Trump and Xi agree to talks

FTSE hits nine-month high as Trump and Xi agree to talksSpeed Read London index joins global rally - but will the market optimism last?

By The Week Staff Last updated

-

New York overtakes London as world’s financial capital

New York overtakes London as world’s financial capitalIn Depth Most financial services executives think Brexit chaos is to blame

By William Gritten Last updated

-

Is formal office dress code dead?

Is formal office dress code dead?Speed Read Goldman Sachs becomes latest firm to issue new guidelines allowing more flexibility over work attire

By The Week Staff Last updated