HSBC shares rise after £1.5bn buyback pledge

Plan takes total returned to investors in past three years to more than $25bn

HSBC has reported a rise in profits and a new share buyback programme, sending shares rising in London and Hong Kong.

Europe's largest lender will buy back $2bn (£1.5bn) more shares by the end of this year, adding to the $3.5bn (£2.7bn) it reacquired in the past 12 months, says the BBC.

"The bank said its latest share buyback plans would take the total returned to investors in the past three years to over $25bn (£19bn)," says the Financial Times.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Share buybacks, which are typically made at a premium to the prevailing market price, are used by public companies to return capital to investors. By reducing the volume of shares being openly traded, they also have the effect of boosting the price by reducing supply and bolstering per-share earnings, which is a primary method by which a stock's value is calculated.

HSBC has been restructuring its operations in the past year, selling off non-core business units in markets such as Brazil and shedding staff as it seeks to reduce costs and maintain dividend payout rates.

However, this has come at a cost and the bank has also incurred $500m (£380m) of expenses in ring-fencing its UK retail banking arm and had to set aside an additional $300m (£228m) for PPI compensation, taking the total provisioned so far to £3.3bn.

Despite this, HSBC reported a five per cent rise in profits to $10.2bn (£7.8bn) for the first six months of 2017, with revenue growth particularly growing in its global investment banking arm.

The share price rose three per cent in early London trading, before paring gains back to around two per cent, and rose 2.6 per cent in Hong Kong.

HSBC profits slides by almost a fifth

4 May

HSBC has reported a fall in pre-tax profits of almost a fifth, as the bank spent more on "fighting financial crime", says The Guardian.

First-quarter profits were $5bn (£3.9bn), down 19 per cent on the same period last year.

Announcing the results, the London-headquartered bank added it had spent $800m (£620m) on hiring more staff and bolstering its capabilities to deal with "regulatory programmes and compliance".

The main hit to profit came from exceptional and one-off items, says the Financial Times, including the loss of income from the Brazilian unit the bank sold last year and a change in the fair value of its debt.

The paper adds that HSBC's adjusted profit, which strips out non-recurring items and is keenly watched by investors, was above-expectation at $5.9bn (£4.6bn).

"Europe's biggest bank by assets… benefited from a fall in provisions for bad debts, helped by a positive $100m (£78m) write-back of earlier provisions mainly on oil and gas loans," says the FT.

James Chappell, banking analyst at Berenberg, said: "Overall, a solid set of results with the only disappointment no further [share] buybacks. However, valuation already reflects this."

HSBC shares rose more than three per cent to 665.6p.

HSBC offers customers a choice of ten gender-neutral titles

31 March

HSBC is introducing a list of gender-neutral titles for use with customers who do not identify as male or female or would rather not be identified by their gender.

Unlike other high street banks, such as Royal Bank of Scotland, Barclays and Metro, it is going further than simply adding the prefix "Mx" to the traditional Mr, Mrs or Ms, says the BBC.

Instead, customers can choose from:

MxInd - an abbreviation of "individual"M - used in FranceMisc - an abbreviation of "miscellaneous"Mre - for "mystery"Msr - a combination of Miss and SirMyr - as above and used in other parts of the worldPr - an abbreviation of "person", pronounced "per"Sai - pronounced "sigh" and used in AsiaSer - pronounced "sair" and used in Latin America

In addition, HSBC said it had simplified the process for updating titles on accounts, with customers needing to take a passport, driving licence or birth certificate that supports the change of gender into a branch, and that staff were being trained to help make the process easier.

Once a customer has changed their title, they will be addressed by it when speaking to staff in branch or over the telephone.

A spokesperson for Stonewall, the LGBT lobby group, hailed the bank's policy, saying: "It's great to see an increasing number of organisations prioritise issues affecting trans people.

"The banking sector has taken huge strides towards making lesbian, gay, bi and trans employees and customers feel valued."

However, human rights campaigner Peter Tatchell told the Daily Mail the move risked attracting ridicule.

He said: "It is commendable that HSBC is showing sensitivity and support for transgender customers, but I am not sure ten different titles are necessary. They risk creating confusion, misunderstanding, ridicule and backlash.

"Mx is the emerging consensus as the preferred gender-neutral title. It covers transgender and intersex people and anyone who doesn't identify as male or female."

HSBC breaks 151-year tradition with new chairman

13 March

HSBC has broken with a tradition that has persisted for a century and a half and hired an outsider to be its new chairman.

Mark Tucker, currently chief executive of US insurance giant AIA, takes over from Douglas Flint on 1 October - the first time in the bank's 151-year history that an insider has not been appointed to the role.

He will "step down from his position as chief executive of AIA, the Asian insurance group, and from the board of Goldman Sachs," says The Times.

One of Tucker's main tasks will be to identify a replacement for Stuart Gulliver as chief executive, which he is expected to conclude during 2018, to allow Gulliver to retire.

It will mean the bank has an entirely new management team to lead its next phase of development, after a difficult period that has seen profits shrink and the bank be hit by a number of scandals, including alleged money laundering.

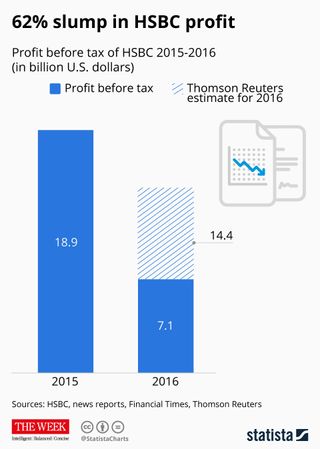

Last week, HSBC reported pre-tax earnings for 2016 of $7.1bn (£5.7bn), down 62 per cent from the $18.9bn (£15.2bn) of the previous year and well below the $14.4bn (£11.6bn) expected by analysts.

It blamed the slump in part on market disruption following the Brexit vote and the election of Donald Trump as US president.

The Times reports that Tucker had "an unusual start" to his career, having been a "footballer at clubs including Wolverhampton Wanderers". He went on to work for Prudential and was appointed to head up its Asian business in 2003 before moving to Hbos.

He returned to the Pru in 2005 and then joined AIA after Prudential failed in its takeover bid in 2010.

HSBC blames Brexit and Trump after 62% profit slump

21 February

HSBC has blamed its massive slump in profit last year on "volatile market conditions" created by the Brexit vote in the UK and the election of Donald Trump in the US.

Pre-tax profits for 2016 were $7.1bn (£5.7bn), the bank reported this morning, down 62 per cent from the $18.9bn (£15.2bn) of 2015 and well below the $14.4bn (£11.6bn) expected by analysts at Thomson Reuters.

The Financial Times said the bank "blamed slowing economic growth in its main markets of Hong Kong and the UK for the profit slide".

Chairman Douglas Flint said last year would "be long remembered for its significant and largely unexpected economic and political events", reports the BBC.

He added: "These foreshadowed changes to the established geopolitical and economic relationships that have defined interactions within developed economies and between them and the rest of the world.

"The uncertainties created by such changes temporarily influenced investment activity and contributed to volatile financial market conditions."

There were also a string of one-off charges to contend with, including a $3.2bn (£2.6bn) impairment charge against HSBC's European private bank and hefty costs related to the sale of its Brazilian arm.

The bank's shares plunged around six per cent to a little more than 669p this morning, although that should be "put in the context of a 50 per cent rise in their value over the past 12 months", adds the BBC.

Investors will also have been disappointed by the announcement that a share buy-back from the proceeds of the Brazilian sale will be only $1bn (£810m), rather than the suggested $2.5bn-3bn (£2bn-2.4bn).

HSBC said it was looking to boost its cost-saving target by a further $1bn (£810m) to as much as $6bn (£4.8bn) in 2017, says the FT.

Infographic by www.statista.com for TheWeek.co.uk.

HSBC to close 62 more branches in final round of cuts

25 January

HSBC has announced it will close even more branches than it had originally planned last year.

The bank says it will cut another 62 outlets over the coming 12 months, some as early as this summer, according to the BBC.

HSBC had already set out plans to cull 55 branches this year. Last year, the bank came top of a Which? survey that looked at high street bank closures over the past two years, after cutting 323 of its branches.

At the beginning of 2015, the branch closures accounted for about a quarter of the network. The Guardian says that by the end of this year, the network will be half the size it was in June 2011 when HSBC had 1,301 branches.

The new cuts will result in "180 roles being lost in branches alongside 204 IT positions being put at risk," the paper adds.

HSBC says the decision to reduce its high street presence reflects the rapid growth in online banking, which now accounts for more than 90 per cent of customer contacts.

A spokesperson said that the latest wave of closures "marks the end of our branch restructuring programme".

Dominic Hook, the national officer of the Unite union, said: "Today is a dark day for hundreds of HSBC staff who will arrive at work to be told that they could lose their job as their branch closes or their IT role is cut.

"Unite is again calling on the banking industry to rethink such branch culling exercises, which do nothing to reassure customers or staff that banking is accessible and open to all."

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

'Making a police state out of the liberal university'

'Making a police state out of the liberal university'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

8 looming climate tipping points that imperil our planet

8 looming climate tipping points that imperil our planetThe Explainer New reports detail the thresholds we may be close to crossing

By Devika Rao, The Week US Published

-

Try 6 free issues of The Week Junior

Try 6 free issues of The Week JuniorSpark your child's curiosity with The Week Junior - the award-winning current affairs magazine for 8-14s.

By The Week Published

-

The Silicon Valley Bank collapse

The Silicon Valley Bank collapsefeature Sudden failure of tech sector’s go-to bank sparks fears of wider contagion

By The Week Staff Published

-

Minimum service levels and the right to strike

Minimum service levels and the right to strikeTalking Point Government’s proposed anti-strike laws will soon be debated by MPs

By Kate Samuelson Last updated

-

Unions of all kinds are flexing their muscles. Should we be celebrating?

Unions of all kinds are flexing their muscles. Should we be celebrating?feature New Unite union boss Sharon Graham has promised to make every UK workplace ‘action ready’ and vowed to take on Amazon

By The Week Staff Published

-

Unite: extend furlough scheme now or ‘redundancy floodgates will open’

Unite: extend furlough scheme now or ‘redundancy floodgates will open’Speed Read Union calls for immediate government action to save workers and business from ‘cliff edge’

By Mike Starling Last updated

-

HSBC to cut 35,000 jobs: why profits plunged

HSBC to cut 35,000 jobs: why profits plungedIn Depth British bank announces 33% drop in profits and plans to slash branches in US

By The Week Staff Last updated

-

Could ‘banking hubs’ solve problem of branch closures?

Could ‘banking hubs’ solve problem of branch closures?Speed Read MPs fear large sections of society could face ‘financial exclusion’

By The Week Staff Last updated

-

What is Britain’s worst bank?

What is Britain’s worst bank?Speed Read Royal Bank of Scotland comes joint-bottom in the new personal banking league table, and last for business banking

By The Week Staff Last updated

-

FBI warns cash machine global cyber-attack imminent

FBI warns cash machine global cyber-attack imminentSpeed Read British banks have been warned their ATMs could be mass-hacked by cyber criminals ‘in the coming days’

By The Week Staff Last updated