Boris Johnson’s manifesto-busting tax rise to fund social care

Health secretary pushing for hike in National Insurance amid social care crisis

Boris Johnson is considering an increase in National Insurance rates to pay for a major overhaul in social care and to bring down NHS waiting lists.

The rumoured move would break a Tory pledge made before the 2019 election, when the Conservative manifesto promised “not to raise the rates of income tax, National Insurance or VAT”.

Appearing on BBC Breakfast, Justice Secretary Robert Buckland did not deny reports of a tax rise but said the British public is “sensible enough to know that when it comes to the issue of social care we have to find some way in which it will be adequately funded”.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

However, the rumoured tax hike is already causing controversy across the political spectrum.

Why is a tax rise being discussed?

Sajid Javid is pushing for a 2% increase in National Insurance contributions (NICs) amid rising concern over the state of social care in the UK, two senior government sources told The Times. The health secretary is said to be concerned that proposals for a 1% rise in NICs for employers and employees, which would raise about £10bn, would not be enough to bring down waiting lists and revamp the care sector.

Johnson is also expected to “cap” the amount an individual will have to pay in social care costs, the paper added, possibly at around £50,000.

The BBC reported in June that the care system is “under pressure across the UK after past governments failed to reform or fund the council-run system properly”. Councils, which provide social care, have seen their budgets slashed over the last decade due to austerity cuts and the issue, which long predates Covid-19, has worsened as a result of the pandemic.

Sources told The Times that hospitals need help from the Treasury to treat Covid-19 patients and clear a backlog of more than five million patients that is “frighteningly large”.

The NHS in England is treating more than 6,000 Covid patients, and health chiefs have warned that continued demand for care, combined with the need for measures due to the pandemic, will add £4.6bn to normal costs next year.

Who will pay?

The BBC calculated that someone on average earnings of £29,536 a year would pay an additional £199.68 annually if NICs were increased by 1%.

According to The Telegraph, an employed worker earning £60,000 a year would pay £504 more a year in NICs if the main rate increased from 12% to 13% and the upper NI rate was raised from 2% to 3%.

The paper added that the tax hike would likely hit around 30 million people, describing the move as “a long awaited bid to solve the funding dilemma facing the adult social care sector”.

What has the reaction been?

Writing in the New Statesman, Rachel Cunliffe described the proposal as “effectively a tax on their opponent’s base to fund benefits for their own”.

Describing an increase to NICs as “deeply unjust”, she added that the plan would see the government “saddle the working young with a deeply regressive tax rise” and “the wealthiest in society being subsidised by the poorest”.

The Spectator is not impressed either, with economics editor Kate Andrews labelling the plan as a “big U-turn” and warning that “Tories who renege on their promise not to raise taxes usually struggle to be re-elected”.

Crunching some numbers, Andrews added that the funding stream of taxing the working-age population more to support the old is becoming “increasingly unsustainable”. In 1971, there were 4.6 working-age people for every person over 65 but, she said, the figure is now down to 3.3 and by 2050 it is predicted to fall to 2.3.

“The government isn’t just running out of other people’s money; it’s running out of workers, too,” she said.

Many commentators have also pointed out that a tax rise would also break a manifesto commitment, with Spectator editor Fraser Nelson writing in The Telegraph that Johnson “has a Jesuitical excuse ready: technically, it’s not a tax rise. It’s a new National Insurance surcharge!”

However, he added that “it will, of course, be seen for what it is: an open betrayal of the pledge on which he was elected”.

Also writing in The Telegraph, former health secretary Jeremy Hunt suggested a different way forward, arguing that there should be a new “health and care premium” added to tax. He then told Today on BBC Radio 4: “Since older people are the biggest beneficiaries I think it's only fair that they should make a contribution.”

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Italian senate passes law allowing anti-abortion activists into clinics

Italian senate passes law allowing anti-abortion activists into clinicsUnder The Radar Giorgia Meloni scores a political 'victory' but will it make much difference in practice?

By Chas Newkey-Burden, The Week UK Published

-

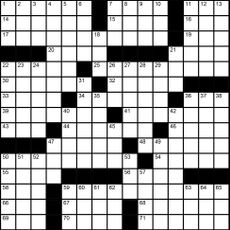

Magazine interactive crossword - May 3, 2024

Magazine interactive crossword - May 3, 2024Puzzles and Quizzes Issue - May 3, 2024

By The Week US Published

-

Magazine solutions - May 3, 2024

Magazine solutions - May 3, 2024Puzzles and Quizzes Issue - May 3, 2024

By The Week US Published

-

Is David Cameron overshadowing Rishi Sunak?

Is David Cameron overshadowing Rishi Sunak?Talking Point Current PM faces 'thorny dilemma' as predecessor enjoys return to world stage

By The Week UK Published

-

Will Aukus pact survive a second Trump presidency?

Will Aukus pact survive a second Trump presidency?Today's Big Question US, UK and Australia seek to expand 'game-changer' defence partnership ahead of Republican's possible return to White House

By Sorcha Bradley, The Week UK Published

-

Can Boris Johnson save Rishi Sunak?

Can Boris Johnson save Rishi Sunak?Today's Big Question Former PM could 'make the difference' between losing the next election and annihilation

By The Week UK Published

-

It's the economy, Sunak: has 'Rishession' halted Tory fightback?

It's the economy, Sunak: has 'Rishession' halted Tory fightback?Today's Big Question PM's pledge to deliver economic growth is 'in tatters' as stagnation and falling living standards threaten Tory election wipeout

By Harriet Marsden, The Week UK Published

-

Why your local council may be going bust

Why your local council may be going bustThe Explainer Across England, local councils are suffering from grave financial problems

By The Week UK Published

-

Rishi Sunak and the right-wing press: heading for divorce?

Rishi Sunak and the right-wing press: heading for divorce?Talking Point The Telegraph launches 'assault' on PM just as many Tory MPs are contemplating losing their seats

By Keumars Afifi-Sabet, The Week UK Published

-

How would a second Trump presidency affect Britain?

How would a second Trump presidency affect Britain?Today's Big Question Re-election of Republican frontrunner could threaten UK security, warns former head of secret service

By Harriet Marsden, The Week UK Published

-

'Rwanda plan is less a deterrent and more a bluff'

'Rwanda plan is less a deterrent and more a bluff'Instant Opinion Opinion, comment and editorials of the day

By The Week UK Published