UK house sales: demand from movers set to outpace first-time buys

Researchers predict that existing homeowners will retake lead in driving property market in 2021

First-time buyers have been a “driving force” for the UK property market over the past decade but according to new data, the proportion of sales to newcomers is on track to be overtaken by those to existing homeowners.

The latest House Price Index Report from Zoopla says that the annual UK house price growth rate stands at 2.6%, up from 1% a year ago. And the number of new sales agreed over the past nine months is 3% higher than the same period last year, despite the sector having had to shut down for the coronavirus lockdown earlier this year.

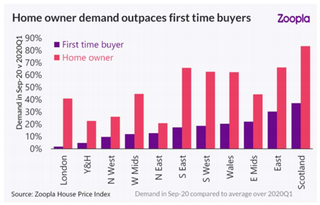

But while an ongoing imbalance between supply and demand is driving the growth rate, a gap is “opening up in relative strength of demand between existing homeowners and first-time buyers”, which has recently been greater among the latter, the property portal reports.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Experts predict that “first-time buyers will make up around 33.9% of home purchases in the UK for 2020, down from a ten-year high of 34.9% in 2019”, says The Guardian.

If correct, that would “mark the first decline in house sales to first-time buyers since 2015”, the newspaper adds.

The Zoopla report points to “restricted mortgage availability, tighter lending criteria and growing economic uncertainty” during the Covid pandemic as the key reasons for the expected drop.

The property site’s research and insight director Richard Donnell said: “First-time buyers have been the engine for the housing market over the last decade, but greater movement amongst existing home owners means a shift in the mix of moving households in 2021.”

‘Existing home-owners to support market’

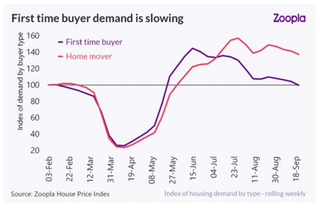

First-time buyer demand spiked immediately after the lockdown ended, but has lost momentum amid the growing economic uncertainty and reduced availability of higher loan to value (LTV) mortgages.

“We expect it to decline slowly over the rest of 2020,” says the Zoopla report. “In contrast, demand from existing home-owners was slower to respond immediately after the lockdown but remains elevated - 37% higher than pre-Covid levels and 53% above this time last year.

“There is pent-up demand in this group that we believe could support the housing market into 2021.”

Demand from first-time buyers over the past ten years had been buoyed by the Help to Buy scheme and greater competition in the higher LTV mortgage market.

In 2019, first-time buyers overtook mortgaged home-owners as the largest buyer group. However, Zoopla says this trend is “set to reverse” moving into 2021, as existing homeowners look to up sticks and take advantage of government incentives such as a stamp duty holiday.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Mike Starling is the digital features editor at The Week, where he writes content and edits the Arts & Life and Sport website sections and the Food & Drink and Travel newsletters. He started his career in 2001 in Gloucestershire as a sports reporter and sub-editor and has held various roles as a writer and editor at news, travel and B2B publications. He has spoken at a number of sports business conferences and also worked as a consultant creating sports travel content for tourism boards. International experience includes spells living and working in Dubai, UAE; Brisbane, Australia; and Beirut, Lebanon.

-

Nigeria's worsening rate of maternal mortality

Nigeria's worsening rate of maternal mortalityUnder the radar Economic crisis is making hospitals unaffordable, with women increasingly not receiving the care they need

By Harriet Marsden, The Week UK Published

-

'Elevating Earth Day into a national holiday is not radical — it's practical'

'Elevating Earth Day into a national holiday is not radical — it's practical'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

UAW scores historic win in South at VW plant

UAW scores historic win in South at VW plantSpeed Read Volkswagen workers in Tennessee have voted to join the United Auto Workers union

By Peter Weber, The Week US Published

-

Sport on TV guide: Christmas 2022 and New Year listings

Sport on TV guide: Christmas 2022 and New Year listingsSpeed Read Enjoy a feast of sporting action with football, darts, rugby union, racing, NFL and NBA

By Mike Starling Published

-

Pros and cons of shared ownership

Pros and cons of shared ownershipPros and Cons Government-backed scheme can help first-time buyers on to the property ladder but has risks

By The Week Staff Published

-

Affordability test scrapped: what ‘huge’ mortgage rule change means for buying a house

Affordability test scrapped: what ‘huge’ mortgage rule change means for buying a houseTalking Point Bank of England cuts red tape on mortgage approval process despite soaring inflation

By The Week Staff Published

-

House of the Dragon: what to expect from the Game of Thrones prequel

House of the Dragon: what to expect from the Game of Thrones prequelSpeed Read Ten-part series, set 200 years before GoT, will show the incestuous decline of Targaryen

By Chas Newkey-Burden Published

-

One in 20 young Americans identify as trans or non-binary

One in 20 young Americans identify as trans or non-binarySpeed Read New research suggests that 44% of US adults know someone who is transgender

By The Week Staff Published

-

Is the UK about to see ‘biggest ever’ house price crash?

Is the UK about to see ‘biggest ever’ house price crash?In Depth House prices have risen for fourth month in a row but it remains a 'buyers' market

By Rebekah Evans, The Week UK Last updated

-

The Turner Prize 2022: a ‘vintage’ shortlist?

The Turner Prize 2022: a ‘vintage’ shortlist?Speed Read All four artists look towards ‘growth, revival and reinvention’ in their work

By The Week Staff Last updated

-

‘Weakest since 2012’: UK house price average falls to £257,406

‘Weakest since 2012’: UK house price average falls to £257,406In Depth Prices down 1.1% year-on-year in February – the first annual decline since June 2020

By The Week Staff Last updated