Royal Mail: shares surge as trading begins

Conditional trading starts today but anyone who applied for more than £10,000 won't get a thing

Shares in the newly privatised Royal Mail jumped by 38 per cent in the first few minutes of trading on the London Stock Exchange.

The price, which had been set at 330p per share, reached a peak of 456p before settling back to 437p by 3pm - a rise of 32 per cent. That represents a paper profit of £240 for private investors who took part in the Royal Mail offer.

Investors who applied for up to £10,000 worth of shares - around 690,000 investors - will receive 227 shares worth £749.10. But the 34,500 investors who applied for more than £10,000 worth of shares will get nothing.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

In total, more than 270,000 applicants will receive at least half of the shares for which they applied.

Demand for shares in the mail service reached unexpectedly high levels, making it one of the most sought-after privatisations since the 1980s sell-off of state assets.

Critics last night claimed the decision had been made to enable the government to boast that it was a "people's privatisation".

Financial institutions, such as pension funds and hedge funds, took 67 per cent of all shares on offer, leaving the rest to small investors and Royal Mail workers.

Despite the looming postal workers' strike ballot, 99.7 per cent of Royal Mail employees took up their free allocation of shares. Any employees who applied for extra shares also had their applications met for up to £10,000.

Billy Hayes, general secretary of the Communication Workers Union, which is vehemently against privatisation, said he did not expect the take-up to affect the outcome of next week's strike ballot. He told the BBC: "In austerity Britain no one is going to turn down free money. The real test will be next Wednesday, and I am convinced that postal workers will vote for action."

Conditional trading began today at 8am - a process likened to the gap between exchange and completion when buying a home. Any trades agreed will not be fulfilled until full open market trading begins on Tuesday 15 October.

Shares look set to rise from 330p to around 400p by the end of day one, which would give investors with £749.10 of shares a profit of £158.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

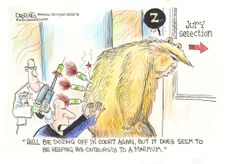

5 sleeper hit cartoons about Trump's struggles to stay awake in court

5 sleeper hit cartoons about Trump's struggles to stay awake in courtCartoons Artists take on courtroom tranquility, war on wokeness, and more

By The Week US Published

-

The true story of Feud: Capote vs. The Swans

The true story of Feud: Capote vs. The SwansIn depth The writer's fall from grace with his high-flying socialite friends in 1960s Manhattan is captured in a new Disney+ series

By Adrienne Wyper, The Week UK Published

-

Scottie Scheffler: victory for the 'pre-eminent golfer of this era'

Scottie Scheffler: victory for the 'pre-eminent golfer of this era'Why Everyone's Talking About Masters victory is Scheffler's second in three years

By The Week Staff Published

-

Why is Royal Mail failing to deliver?

Why is Royal Mail failing to deliver?Today's Big Question The 507-year-old British institution is facing carve-up and even insolvency with decline of letter writing

By The Week Staff Published

-

Labour shortages: the ‘most urgent problem’ facing the UK economy right now

Labour shortages: the ‘most urgent problem’ facing the UK economy right nowSpeed Read Britain is currently in the grip of an ‘employment crisis’

By The Week Staff Published

-

Will the energy war hurt Europe more than Russia?

Will the energy war hurt Europe more than Russia?Speed Read European Commission proposes a total ban on Russian oil

By The Week Staff Published

-

Will Elon Musk manage to take over Twitter?

Will Elon Musk manage to take over Twitter?Speed Read The world’s richest man has launched a hostile takeover bid worth $43bn

By The Week Staff Last updated

-

Shoppers urged not to buy into dodgy Black Friday deals

Shoppers urged not to buy into dodgy Black Friday dealsSpeed Read Consumer watchdog says better prices can be had on most of the so-called bargain offers

By The Week Staff Published

-

Ryanair: readying for departure from London

Ryanair: readying for departure from LondonSpeed Read Plans to delist Ryanair from the London Stock Exchange could spell ‘another blow’ to the ‘dwindling’ London market

By The Week Staff Published

-

Out of fashion: Asos ‘curse’ has struck again

Out of fashion: Asos ‘curse’ has struck againSpeed Read Share price tumbles following the departure of CEO Nick Beighton

By The Week Staff Published

-

Universal Music’s blockbuster listing: don’t stop me now…

Universal Music’s blockbuster listing: don’t stop me now…Speed Read Investors are betting heavily that the ‘boom in music streaming’, which has transformed Universal’s fortunes, ‘still has a long way to go’

By The Week Staff Published